WTI Slips as OPEC+ Voluntary Cuts Fail to Convince

OIL PRICE FORECAST:

- Oil Failed at the 200-Day MA as the Technical and Fundamental Factors Weighed on the Price.

- OPEC+ Announce 2 Million bpd Cuts for Q1 2024 but it Appears Markets Expected More.

- Will the Bulls Recover or is a Retest of $70 a Barrel on the Cards?

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Oil Price Forecast: WTI Faces Technical Hurdles as OPEC+ Rumors Swirl

Oil prices rose this morning coming within a whisker of the psychological $80 a barrel mark. However, the OPEC+ meeting which was supposed to inspire a break back above the $80 handle had the opposite effect with a selloff ensuing in the aftermath.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

OPEC+ VOLUNTARY CUTS AND BRAZIL TO JOIN

The OPEC+ meeting today through up a host of challenges if sources are to be believed. There was a lot of differing views from sources as markets waited with bated breath for an announcement on potential cuts.

The announcement finally came that an agreement had been reached for voluntary cuts of around 2 million barrels a day for Q1 next year. Saudi Arabia extending its voluntary output cuts as the virtual meeting today failed to find a solution. Eventually however members did agree to go along with voluntary cuts with Saudi, Kuwait, Russia, Algeria and Kazakhstan said cuts would be gradually unwound after Q1 of 2024.

Some of the cuts announced by OPEC+ members were 42k barrels/day from Oman, Iraq 220k barrels/day, UAE 163k barrels/day and then of course the extended cuts by Saudi Arabia and Russia leaving the total around 2.19 million barrels per day. The last surprise that came out of the OPEC+ meeting was the invite to Brazil to join the group with the Brazilian Energy Minister saying he hoped to join by January.

Another concern for oil producer and the US came from EIA data today which showed that Crude and Petroleum products supply fell in September to 20.09 million barrels per day which is the lowest since April. This could further fuel concerns of a global slowdown as we head into 2024.

Recommended by Zain Vawda

How to Trade Oil

LOOKING AHEAD

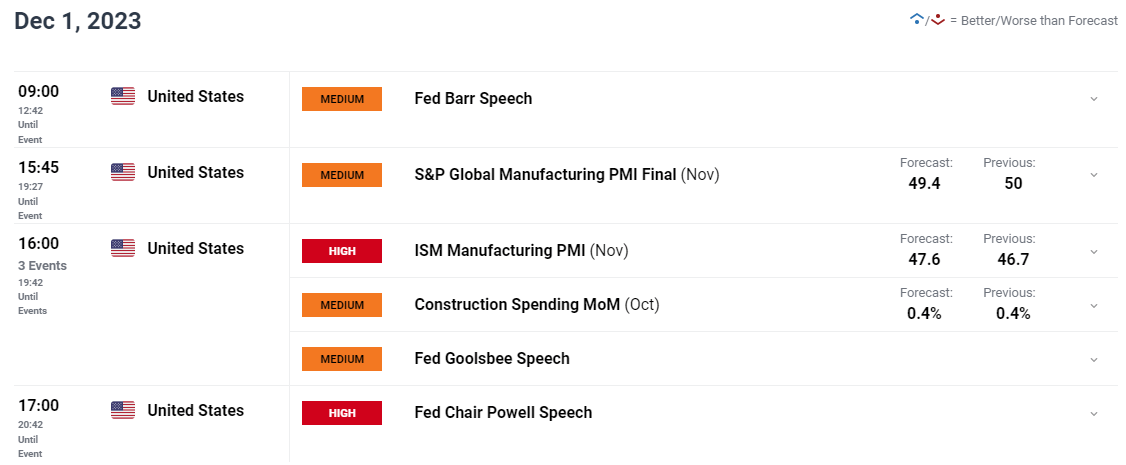

US Data lies ahead and could have an impact on Oil prices. Part of the decline today could be attributed to a stronger US Dollar and rising US yields which had an impact on risk appetite.

Tomorrow, we have manufacturing PMI data as well as speeches by Fed Policymakers which get more interesting by the day. Today’s comments (at least to me) struck a more hawkish tone than we have heard over the past couple of days and could also in part explain the rise in the US Dollar.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

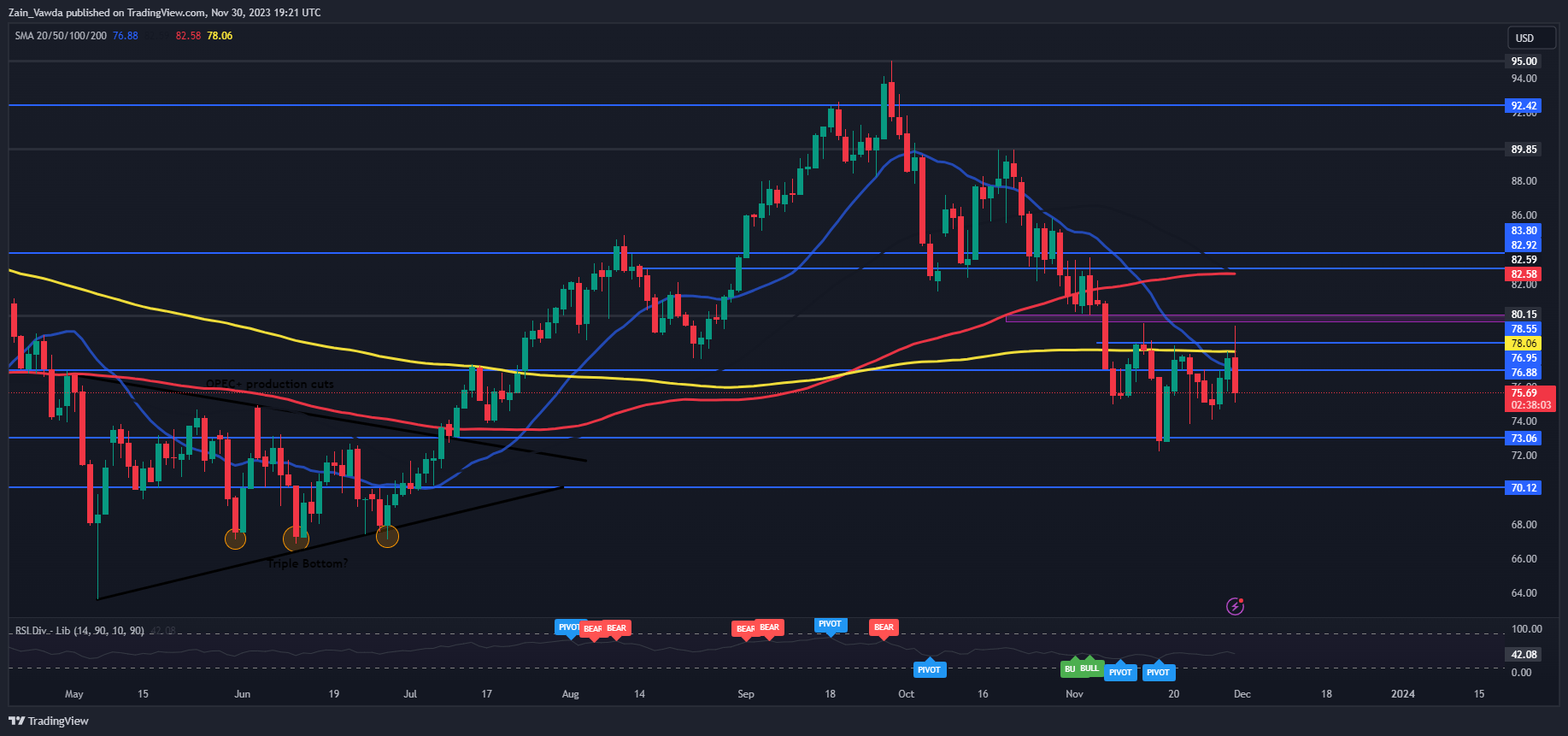

From a technical perspective WTI failed to close above the 200-day MA today despite trading above the moving average for large parts of the day. As i mention in my article yesterday (see here), WTI did remain in a bearish structure with a break above the and daily candle close above the $78.06 swing high needed to confirm a shift in structure and put the bulls in control.

As things stand there is a real chance that Oil could remain rangebound between the recent lows around the $73 mark and the $78 a barrel handle. We are seeing a death cross pattern complete today as well with the 50-day MA crossing below the 100-day MA which could embolden bears heading into the weekend.

WTI Crude Oil Daily Chart – November 30, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 76.95

- 78.06

- 80 (psychological level)

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 86% of Traders are currently holding LONG positions, up from 82% yesterday. Given the contrarian view to client sentiment adopted here at DailyFX, does this mean we are destined to revisit recent lows?

For a more in-depth look at WTI/Oil Price sentiment and how to use it, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 24% | 3% |

| Weekly | 2% | -5% | 1% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.