Struggles around 188.00, on soft UK inflation

- GBP/JPY slips below 188.00, but it remains trading in the green amid a risk-on mood.

- A daily close below 188.00 could pave the way for a deeper pullback, 187.00 would be the bears' target.

- Further upside above 188.28, and GBP/JPY would challenge an eight-year high at 188.80.

The British Pound (GBP) remains steady against the Japanese Yen (JPY) during Wednesday’s mid-North American session after reaching a daily high of 188.24; the pair has fallen below the 188.00 mark, courtesy of weak inflation data from the UK. Therefore, the GBP/JPY hovers around 187.94, virtually unchanged.

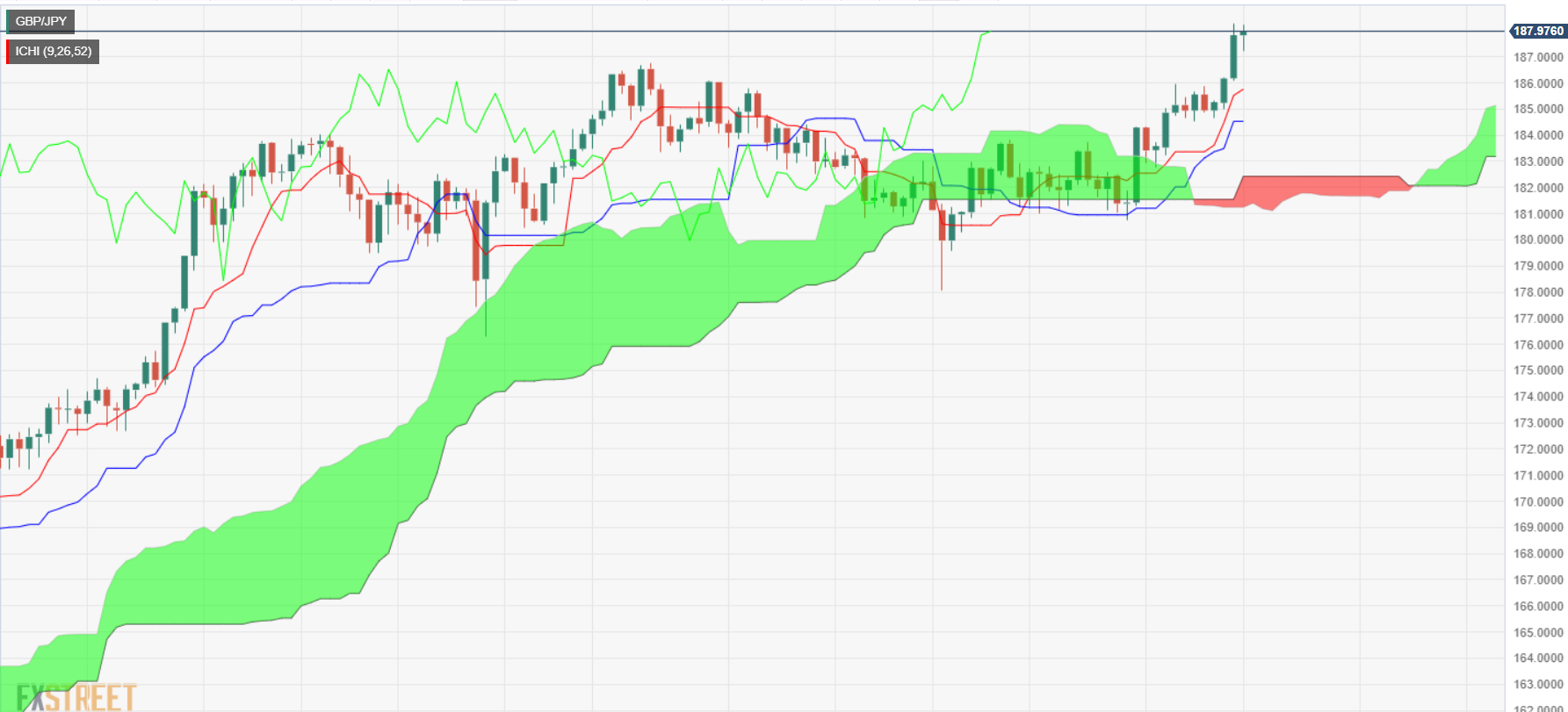

From a technical perspective, the GBP/JPY is upward biased, but a daily close below 188.00 could pave the way for a deeper pullback, which could extend toward the 187.00 figure. If sellers push prices below that level, the next demand area could be the Tenkan-Sen at 185.75m followed by the Senkou Span A at 185.13. the next support would be 185.00

On the other hand, the GBP/JPY uptrend would continue if it remains above 188.00, with the first resistance seen at the current year-to-date (YTD) high of 188.28. Sentiment further improvement would put into play the November 2015 swing high at 188.80 before buyers challenge the 190.00 figure.

GBP/JPY Price Analysis – Daily Chart

GBP/JPY Technical Levels

Comments are closed.