EUR/USD Hindered by Resistance, EUR/AUD Still in Bullish Trend

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Outlook: USD/JPY Flat, AUD/USD Dives after Rejection, USD/MXN Soars

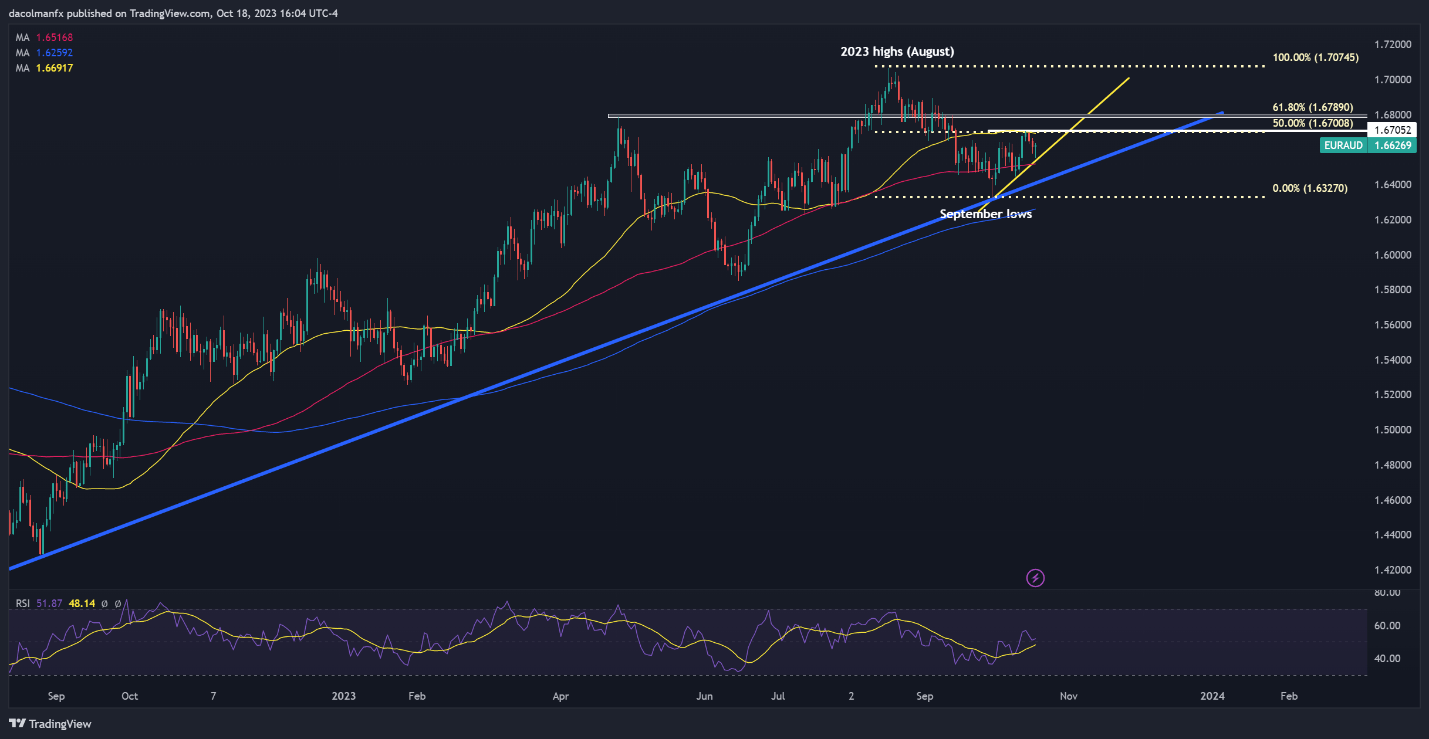

EUR/USD TECHNICAL ANALYSIS

EUR/USD pulled back on Wednesday after failing to clear channel resistance located just below the 1.0600 handle, thereby putting an end to a two-day winning streak. The retreat was amplified by the broad-based strength of the U.S. dollar, driven by the substantial rise in U.S. government yields. For context, the entire U.S. Treasury curve shifted upwards, with the 10-year note soaring past 4.90%, its highest level since 2007.

With U.S. yields steadily increasing due to the resilience of the U.S. economy, and geopolitical tensions in the Middle East on the rise, the euro is likely to maintain a bearish bias against the greenback in the near term, with fresh 2023 lows possibly just around the corner.

From a technical standpoint, if EUR/USD deepens its retrenchment in the days ahead, trendline support at 1.0500 could provide stability to the market and ease the downward pressure, but in case of a breakdown, the pair is likely to gravitate towards its 2023 trough at 1.0448. On further weakness, sellers could steer the exchange rate towards an important floor near 1.0350.

On the flip side, if sentiment shifts in favor of the bulls and prices resume their recovery, overhead resistance extends from 1.0600 to 1.0625. Successfully piloting above this technical barrier could reinforce upward momentum, paving the way for a rally towards 1.0765, the 38.2% Fibonacci retracement of the July/October sell-off.

Wondering where the euro is headed and what fundamental drivers will be important in the months ahead. Discover the answers in our free Q4 trading forecast. Get your copy now!

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

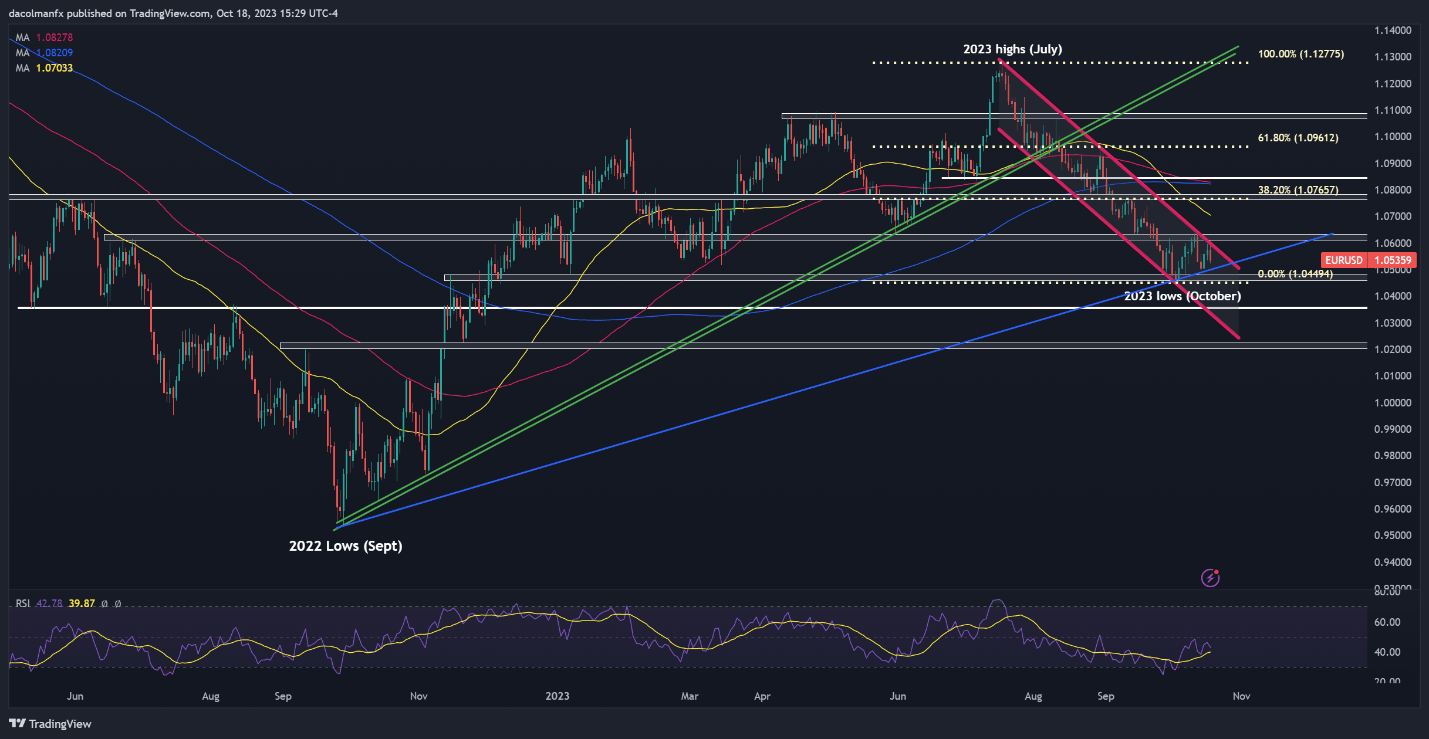

EUR/AUD TECHNICAL ANALYSIS

EUR/AUD fell towards multi-month lows in late September, but started to rebound soon after. Negative market sentiment in the face of heightened geopolitical tensions in the Middle East reinforced the pair's recovery, pushing prices towards the 50-day simple moving average and the 50% Fibonacci retracement of the August/September decline, an area that currently presents a formidable hurdle for the bulls (~1.6700)

Looking ahead, it is essential for traders to keep a watchful eye on two critical technical zones: overhead resistance around 1.6700 and short-term trendline support at 1.6545, which also roughly coincides with the 100-day simple moving average.

When considering potential outcomes, a resistance breakout could send EUR/AUD towards 1.6790 (corresponding to the 61.8% Fibonacci retracement). In the event of sustained strength, the spotlight will shift to this year's peak. Conversely, if support is breached, sellers may be emboldened to drive prices towards 1.6400. Below that threshold, attention will shift to the lows observed in September.

Curious about the influence of retail positioning on the short-term outlook for the euro? Our sentiment guide holds the answers you're looking for. Don't miss out, download it right away!

Recommended by Diego Colman

Improve your trading with IG Client Sentiment Data

EUR/AUD TECHNICAL CHART

EUR/AUD Chart Created Using TradingView

Comments are closed.