Rand Approaches Key Support as FOMC Minutes Looms

RAND TALKING POINTS & ANALYSIS

- Decline in US Treasury yields sustaining rand upside as PPI’s push higher.

- Attention n shifts towards FOMC minutes and Fed officials.

- Rising wedge support being eyed by ZAR bulls.

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand found its footing this week despite the US dollar’s safe haven appeal due to the Israel-Palestine war. Consequently, US Treasury yields have taken a backseat thus favoring the ZAR while being supplemented by some dovish talk by certain Fed officials. That being said, not all Fed officials share the same sentiment with the Fed’s Bowman reinforcing tighter monetary policy by stating “ The US policy rate may need to rise further”. There will be more Fed guidance throughout today’s trading sessions (see economic calendar below) as markets prepare for the FOMC minutes.

US PPI supplemented Michelle Bowman’s thoughts by surprising to the upside on both headline and core prints respectively. The data could translate through to elevated inflationary pressures via the CPI report in the upcoming months due to the rise in crude oil prices. With OPEC expecting greater demand for crude oil as well as Middle Eastern tensions on the rise, this trend may well continue placing greater pressure on the Fed to hike rates this year. The weaker dollar is allowing for some major South African commodities to find support and will help buoy the rand against the greenback.

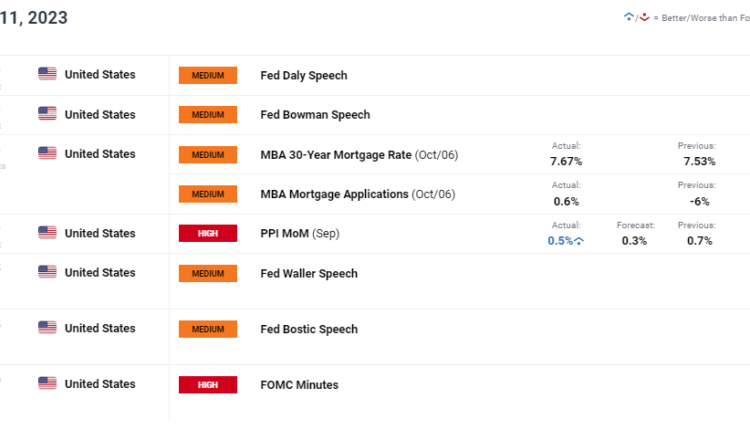

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free USD Forecast

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily USD/ZAR price action has retreated from the rising wedge resistance (dashed black line)/19.5000 and now looks to test the support structure of the pattern. The 50-day moving average (yellow) is also under threat but will likely find a firm footing with regard to directional bias post tomorrow’s US CPI. The Relative Strength Index (RSI) trades around the 50 midpoint level and suggests no preference towards neither bulls nor bears at this time – indicative of market hesitancy.

Resistance levels:

- 19.5000/Wedge Resistance

- 19.3000

- 19.0000

- 50-day MA

Support levels:

- Wedge support

- 18.7759

- 18.5000

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.