Australian Dollar Dips as US Dollar Rallies After Israel Attack. Lower AUD/USD?

Australian Dollar, AUD/USD, BoJ, RBA, Fed, Treasury Yields, ACGB, JGB – Talking Points

- The Australian Dollar lost its footing going into Monday’s trading session

- The news of violence erupting in the Middle East has roiled markets

- Treasury yields and the US Dollar are stretching higher. Will that sink AUD/USD?

Recommended by Daniel McCarthy

How to Trade AUD/USD

The Australian Dollar sunk on Monday morning after weekend news of an all-out assault by the terrorist group Hamas on Israel, opening up another theatre of war.

The US Dollar is broadly stronger to start the week but especially so against the growth and risk sensitive currencies such as the Aussie and Kiwi. The Japanese Yen and Swiss Franc have fared better on their perceived haven status.

Futures markets are pointing toward lower prices for equities across Asia, Europe and North America later today. It is a holiday in Japan and the US which may contribute to slipperier market conditions than would otherwise be the case on potentially less liquidity.

The US Dollar had already been underpinned by Treasury yields continuing their march north after a solid jobs report on Friday that saw 336k jobs added in September.

The benchmark 10-year note eclipsed 4.88% on Friday, the highest return for the low-risk asset since 2007. It has since settled near 4.80%.

By comparison, the yield on the Australian Commonwealth Government Bond (ACGB) has slipped under 4.50% today after nudging 4.70% last week.

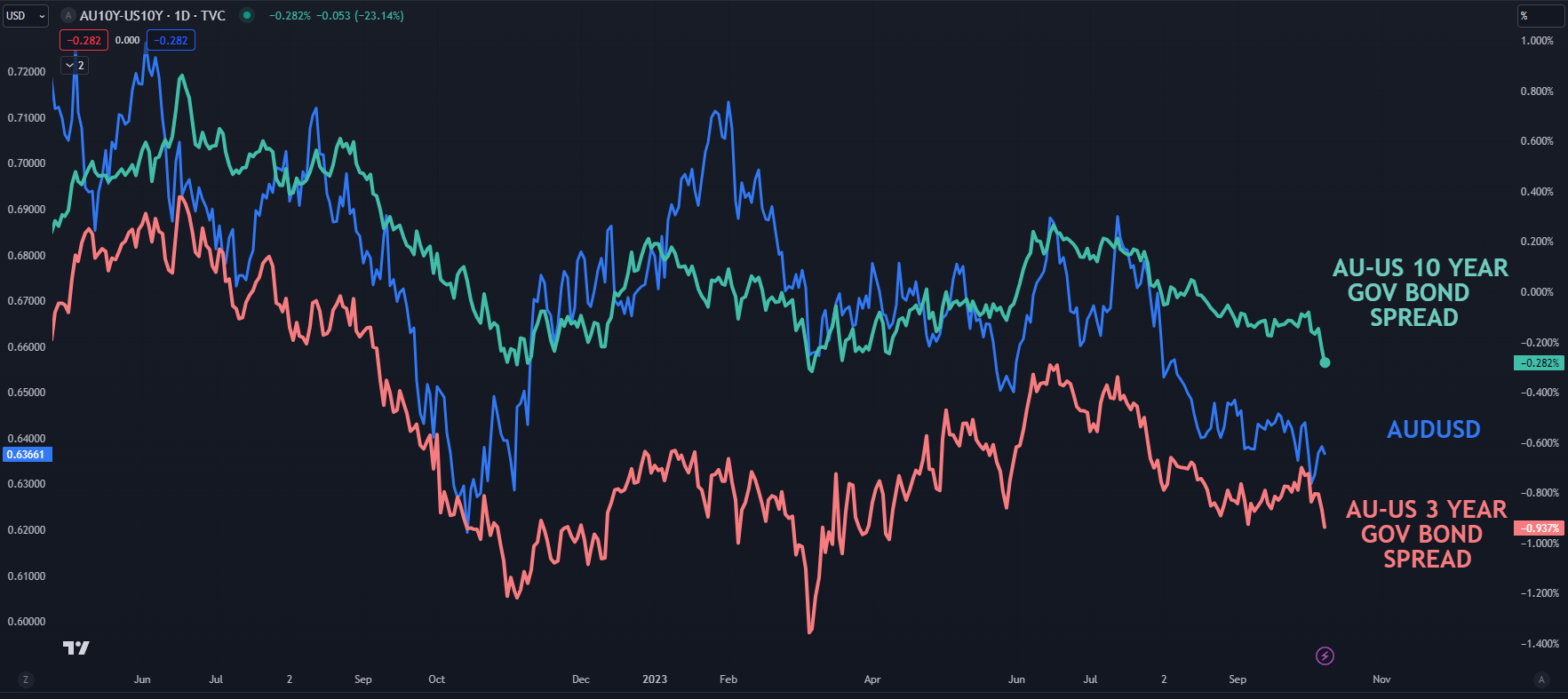

Government bond spreads have historically seen fluctuating correlation to AUD/USD but the moves to start this week have moved aggressively in favour of the US Dollar.

AUD/USD, 3- AND 10-YEAR AU-US BOND SPREADS

Chart created in TradingView

Gold, silver and crude oil futures prices have opened higher on a combination of haven buying for the precious metals and possible supply constraints and increased demand for energy.

At the time of going to print, most other commodity futures are yet to open and if risk aversion is a theme for the trading session ahead, excessive volatility may unfold.

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

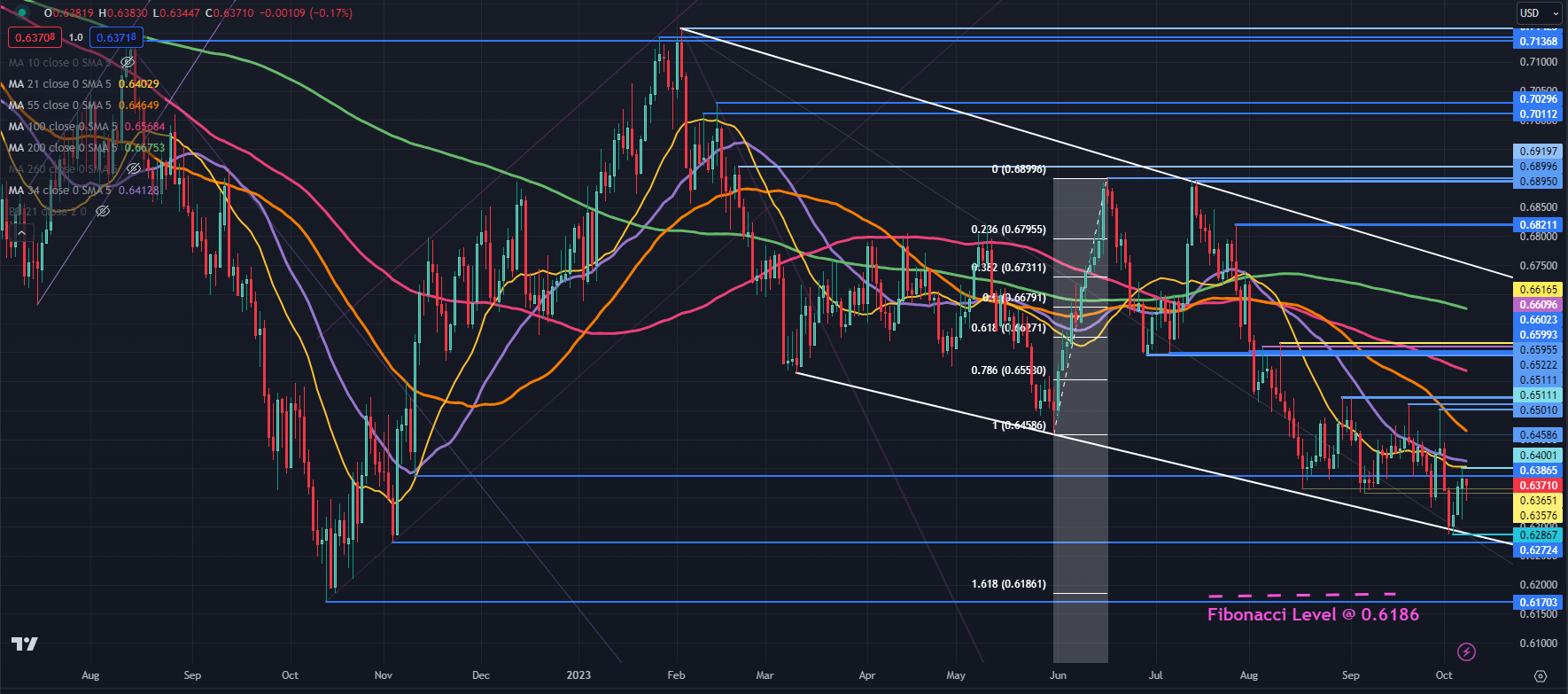

AUD/USD TECHNICAL ANALYSIS

AUD/USD rejected a move below a descending trendline last week but overall remains in a descending trend channel.

It briefly traded above a historical breakpoint of 0.6387 on Friday but was unable to sustain the move and it may continue to offer resistance.

That peak of 0.6400 coincides with the 21-day Simple Moving Average (SMA) and that level may offer resistance ahead of the 34-day SMA, currently near 0.6412.

The inability of the Aussie to move above these SMAs could suggest that bearish momentum is intact for now. A move above the 21- and 34-day SMAs might indicate more sideways price action.

The 0.6500 – 0.6520 area contains a series of prior peaks and might be a notable resistance zone. Further up, the 0.6600 – 0.6620 area might be another resistance zone with several breakpoints and previous highs there.

On the downside, support may lie near the previous lows of 0.6285, 0.6270 and 0.6170.

The latter might also be supported at 161.8% Fibonacci Extension level at 0.6186. To learn more about Fibonacci techniques, click on the banner below.

Recommended by Daniel McCarthy

Traits of Successful Traders

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.