Event Guide: U.S. Non-Farm Payrolls Report for October 2023

The monthly U.S. employment update is here and with markets starting to see inflation and growth slowing, will this be the big catalyst to push traders all-in on the peak rate hike cycle narrative?

This could be a big event so check out what market analysts expecting and how we think USD may react.

Here’s what to know before creating your risk management plan for the U.S. employment report for September.

Event in Focus:

U.S. Monthly Employment Situation Summary from the U.S. government for September 2023

When Will it Be Released:

October 6, Friday: 12:30 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

U.S. Non-Farm Payrolls Change m/m: +150K forecast vs. +187K previous

U.S. Average Hourly Earnings m/m: +0.3% m/m forecast vs. 0.2% m/m previous

U.S. Unemployment Rate: 3.8% forecast vs. 3.8% previous

(as forecasted at 5:00 pm GMT on Oct. 4)

Relevant U.S. Data Since the Last U.S. Non-Farm Payrolls Report:

🟢 Arguments for net Strong Jobs Update / Potentially Bullish USD

ISM U.S. Manufacturing PMI for September – Employment Index increased to 51.2 vs. 48.5 previous

🔴 Arguments for net Weak Jobs Update / Potentially Bearish USD

ADP U.S. Private Payrolls for September: 89K (160K forecast; 180K previous)

ISM Services PMI for September – Employment Index: 53.4 vs. 54.7 previous

JOLTs U.S. Job Openings: 9.61M (8.6M forecast; 8.92M previous)

Previous Releases and Risk Environment Influence on USD

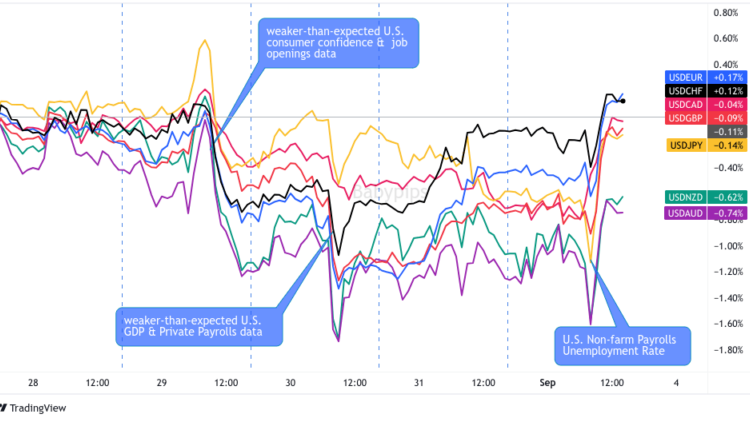

September 1, 2023

Overlay of USD Pairs: 1-Hour Forex Chart by TradingView

Action / results:

The U.S. Non-Farm Payrolls update for August came in at 187K (180K forecast) net jobs added, while the July read was revised lower to 157K from 209K. The unemployment rate ticked higher to 3.8% from 3.5% unexpectedly, and average hourly earnings grew at a slower rate at +0.2% m/m.

This was arguably mixed but taken as a net USD positive as it signaled overall persistent strength in the U.S. job market, lifting speculation of a “soft landing” scenario despite a high interest rate environment.

Risk environment and intermarket behaviors:

This trading week was influenced mainly by shifting rate hike and recession odds, shaped by U.S. jobs updates, global business sentiment surveys and inflation updates.

Early week weakness in the data raised peak Fed rate hike cycle speculation, which brought on apparent anti-Dollar vibes, as well as some recession fears bets characterized by a fall in bond yields.

August 4, 2023

Action / results:

The U.S. Non-Farm Payrolls figure for July fell short of estimates at 187K versus the 190K forecast, but the unemployment rate managed to dip from 3.6% to 3.5% instead of holding steady.

Wage growth was also slightly stronger than expected, as the average hourly earnings figure saw another 0.4% uptick.

After a weak start on Monday, the dollar was able to get back on its feet when the Fed hinted at keeping rates “higher for longer.” The U.S. credit rating downgrade by Fitch midweek caused a bit of retreat, but the safe-haven currency managed to stay afloat.

The dollar gave back a few more gains upon seeing downbeat NFP results, but this wasn’t enough to dethrone the currency from the top spot for the week.

Risk environment and intermarket behaviors:

Risk appetite stemming from Chinese stimulus rumors weighed on safe-havens like the dollar and yen early in the week, but downbeat PMI readings from the Asian giant revived risk-off flows midweek.

A combination of higher U.S. Treasury yields and a credit rating downgrade by Fitch shored up risk aversion later on, weighing on equities and commodities while propping up the lower-yielding dollar leading up to the NFP release.

Price action probabilities

Risk sentiment probabilities:

It’s generally been a pro-Dollar / risk-off kinda week as the main focus continues to be on the “higher for longer” interest rate environment forecast.

But that tone has tempered a bit, possibly on a mix of some USD profit taking ahead of the monthly U.S. jobs update, but possibly on recent global data pointing to signs of economic strength waning and inflation rates easing, mainly noted in this week’s global business survey updates. This of course likely adds support to the peak Fed rate hike cycle trade, and the peak global rate hike cycle overall.

This broad risk environment is likely to continue through the rest of the week into the U.S. Non-farm Payrolls report, and not likely have to a major influence on the jobs report as the official U.S. monthly employment situation update is THE event of the week that will guide sentiment biases ahead.

USD scenarios

Base Case:

The price reaction outlook based on the U.S. employment update is almost always a tough call given that there are so many different components of the government report to take in, and that the component gaining the most trader attention often changes depending on the overall market themes.

With economic growth concerns now starting to outweigh inflation concerns, it’s likely net job adds (and any revisions of previous reads) will likely be the main catalyst of the bunch. That means the net change and the unemployment rate will possibly spark USD moves this time, barring any major surprises with the wage growth number.

Let’s take a quick look at leading indicators, and we can see that the ISM employment index numbers were mixed with the manufacturing sector raised positive sentiment on jobs, while the services sectors showed lower positive sentiment. ADP private payrolls came in well below expectations, so overall, it’s likely the actual read will come out net positive and around the market’s ball park 150K estimate.

Overall, it’s highly possible the actual numbers aren’t going to deviate too far from expectations, and if so, USD may continue today’s reverse lower as traders will likely further price in peak Fed rate hike expectations.

Of course, peak rate hike doesn’t mean rate cuts, so USD sellers may not come in droves, especially since these numbers aren’t likely weak enough to take one final rate hike off the table as the market currently expects.

If these conditions play out and barring any major surprises to wage growth, USD could see a light pullback against the majors heading into the weekend. Look for potential high quality setups against the other safe havens like the Swiss franc and the Japanese yen if broad recession fears / risk-off are still in play.

Again, with so many components to the jobs number, it’s tough to establish a price outlook as odds of a surprise with any of the components are elevated. A good practice would be to wait for the jobs report to release and see how the markets react.

Based on the last two releases, a solid directional move can be observed between the release at 12:30 GMT to 4:00 pm GMT, which means there’s a possibility to catch a short-term intraday trend once the data and market’s take has been established. In other words, you don’t have to take risk before or right at the event release to potentially see a positive outcome if you take the time to risk manage correctly.

This content is strictly for informational purposes only and does not constitute as investment advice. Trading any financial market involves risk. Please read our Risk Disclosure to make sure you understand the risks involved.

Comments are closed.