Euro surrenders some gains and drops to the sub-1.0600 area

- The Euro gathers extra pace vs. the US Dollar.

- Stocks in Europe close Friday's session with decent gains.

- EUR/USD reaches four-day highs near 1.0620.

- The DXY USD Index extends the decline to 105.70.

- Germany reported a firm labour market report.

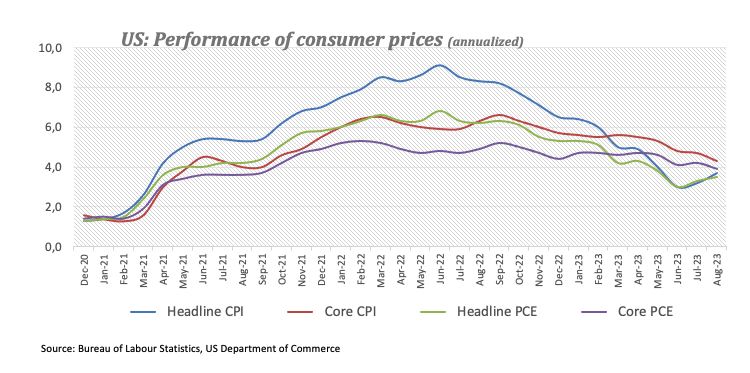

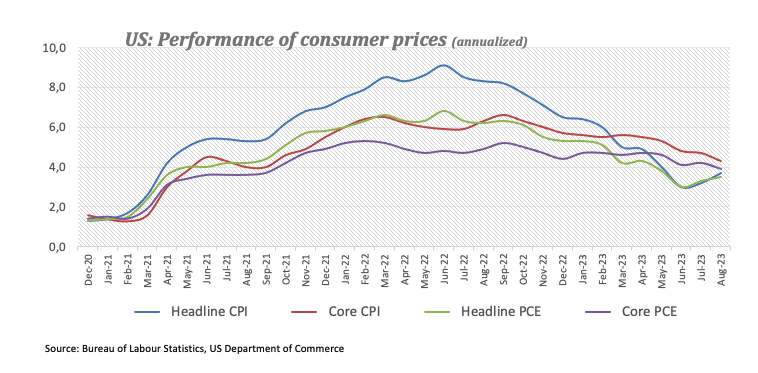

- US headline PCE inflation rose to 3.5% YoY in August.

On Friday, the Euro (EUR) gained significant momentum against the US Dollar (USD), allowing EUR/USD to surpass the important resistance level of 1.0600 and clinch multi-day highs at the same time.

Meanwhile, the Greenback is experiencing a correction from its recent yearly highs around 106.80. It has convincingly breached the support level of 106.00, as indicated by the USD Index (DXY) in response to an improvement in risk sentiment and growing concerns about a potential government shutdown in the United States over the weekend.

The recovery in the pair also comes amidst some loss of momentum in US and German yields after hitting multi-year tops earlier in the week.

The monetary policy outlook remains unchanged, with investors still factoring in a 25 bps interest rate hike by the Federal Reserve (Fed) before the year concludes. Meanwhile, discussions in the market persist regarding a potential impasse in policy adjustments at the European Central Bank (ECB), despite inflation levels that exceed the bank's target and mounting concerns about a potential recession.

In the euro calendar, Retail Sales in Germany contracted 2.3% YoY in August, while the Unemployment Change increased by 10K individuals in September and the Unemployment Rate held steady at 5.7% in the same period. In the broader euro area, flash Inflation Rate for the month of September saw the headline CPI rise at an annualized 4.3% and 4.5% when it comes to the Core CPI (excluding food and energy costs).

Across the pond, inflation gauged by the headline PCE rose 3.5% in the year to August and the Core PCE went up 3.9% over the last twelve months. In addition, Personal Income expanded 0.4% MoM also in August, Personal Spending rose 0.4% from a month earlier and the flash Goods Trade Balance showed a $84.27B deficit in the same month. Later in the NA session, the final print of the Michigan Consumer Sentiment will close the weekly docket.

Daily digest market movers: Euro appears propped up by risk appetite

- The EUR bounces off eight-month lows against the USD.

- US and German yields extend the corrective decline on Friday.

- Investors keep pricing in another rate raise by the Fed before year-end.

- Markets expect a pause at the ECB’s hiking cycle.

- EMU advanced inflation figures extend the downward trend.

- UK Q2 GDP figures surprise to the upside.

- Intervention concerns persist as USD/JPY targets the 150.00 barrier.

- US headline PCE rose marginally in August.

Technical Analysis: Euro faces decent support in the 1.0490/80 band

EUR/USD extends the recovery to the area beyond 1.0600 on Friday, managing to bounce off the oversold zone.

In case the recovery in EUR/USD becomes more serious, the pair should meet the next up-barrier at the September 12 high of 1.0767, prior to the key 200-day Simple Moving Average (SMA) at 1.0828. Should the pair surpass this level, it may pave the way for a test of the transitory 55-day SMA at 1.0855 ahead of the August 30 top at 1.0945 and the psychological hurdle of 1.1000. If the pair clears the latter, it could then challenge the August 10 peak of 1.1064 before the July 27 peak at 1.1149 and the 2023 high of 1.1275 seen on July 18.

On the downside, there is immediate contention at Thursday's low of 1.0491 seconded by the 2023 low of 1.0481 from January 6.

As long as the EUR/USD remains below the 200-day SMA, the potential for downward pressure persists.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Comments are closed.