Euro climbs to two-day highs near 1.0740

- The Euro gathers further steam vs. the US Dollar.

- Stocks in Europe now trade in a mixed fashion.

- EUR/USD advances to daily peaks near 1.0730.

- The USD Index (DXY) breaks below the 105.00 yardstick.

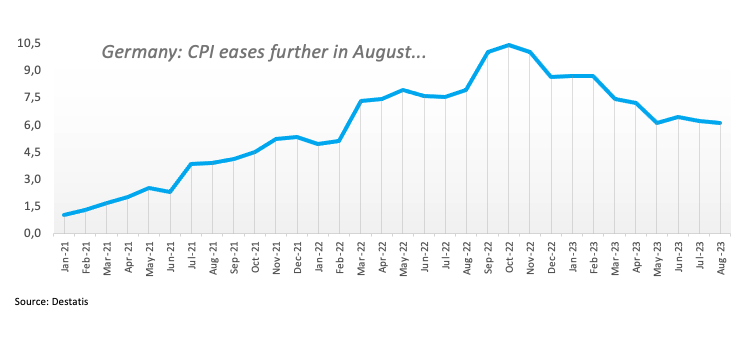

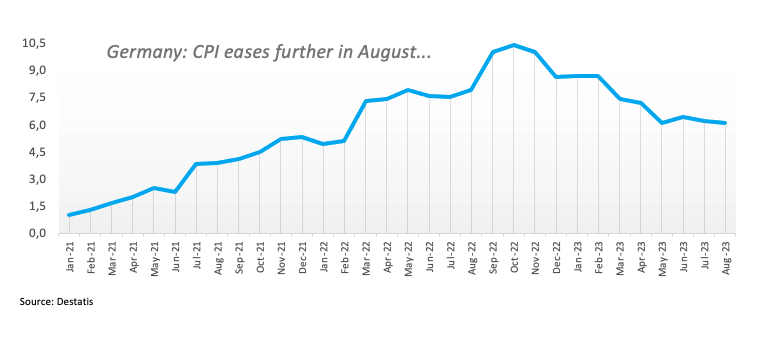

- Final August CPI in Germany matched the preliminary readings.

- Wholesale Inventories, Consumer Credit Change come next in the US docket.

On Friday, the Euro (EUR) manages to gain some upward momentum against the US Dollar (USD), propelling EUR/USD back above the 1.0700 level as the week draws to a close.

The Greenback experienced a partial retreat from its six-month highs above the 105.00 threshold, as indicated by the USD Index (DXY), due to a modest recovery in risk appetite among investors and amidst the absence of a clear direction in the US bond market.

In terms of monetary policy, the speculation surrounding a potential interest rate hike by the Federal Reserve (Fed) in November seems to have lost some momentum. Meanwhile, market participants are still factoring in the likelihood of rate cuts taking place sometime in the second quarter of 2024.

As for the European Central Bank (ECB), there is a notable amount of market discussion suggesting that the upcoming meeting on September 14 may result in a pause, given the divided views within the Council.

In the euro docket, final inflation figures in Germany saw the CPI rise at a monthly 0.3% in August and 6.1% over the last twelve months, unchanged from the preliminary estimates, while Industrial Production in France expanded by 0.8% MoM in July.

Across the pond, US Wholesale Inventories and Consumer Credit Change data are due.

Daily digest market movers: Euro ends the week on a firm note

- The EUR shows some signs of life against the USD.

- US, German yields appear tilted to the downside early on Friday.

- Investors see the ECB keeping the deposit rate unchanged this month.

- Dallas Fed President Lorie Logan favours a pause in September.

- NY Fed President John Williams expects the Unemployment Rate to increase to more than 4%.

- Markets continue to price in Fed rate cuts in Q2 2024.

- Strikes at Chevron LNG plants kick in today.

- Final GDP Growth Rate in Japan came in at 4.8% YoY.

Technical Analysis: Euro does not rule out a deeper decline

EUR/USD is trading with modest gains in the vicinity of the 1.0700 area on Friday after hitting multi-week lows near 1.0680 in the previous session.

Should the EUR/USD manage to breach Thursday's at 1.0685, it may retest the May 31 low of 1.0635 before potentially reaching the March 15 low of 1.0516. A breakdown of the latter level could trigger a possible test of the 2023 low at 1.0481 from January 6.

Conversely, in terms of upward movement, the current focus is on targeting the critical 200-day Simple Moving Average (SMA) at 1.0822. Beyond that, bullish momentum may lead to a challenge of the August 30 level at 1.0945, which is further bolstered by the provisional 55-day SMA at 1.0945. Subsequently, this could set the stage for a move towards the psychological level of 1.1000 and the August high at 1.1064. If the pair manages to clear this area, it might alleviate some of the bearish pressure and potentially aim for the July 27 peak at 1.1149 ahead of the 2023 top at 1.1275 from July 18.

As long as the EUR/USD remains below the 200-day SMA, a sustained decline in the pair is probable.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Comments are closed.