Hang Seng, Kospi, Straits Times Index Setups

HANG SENG, KOSPI, STRAITS TIMES INDEX – Price Action:

- The Hang Seng Index is still looking for a bullish break.

- There is a high chance that Kospi may have peaked for now.

- FTSE Straits Times Index is struggling to find a broader direction.

- What is the outlook and the key levels to watch in select Asian indices?

Recommended by Manish Jaradi

Building Confidence in Trading

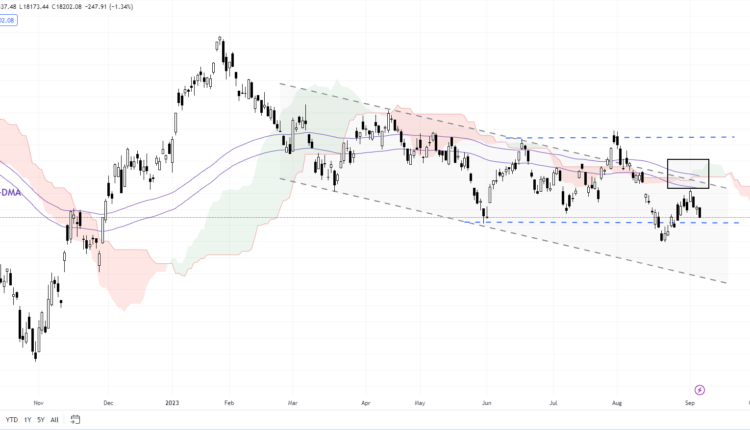

Hang Seng Index: Downward momentum is picking up

The failure of the Hang Seng Index to clear a crucial barrier on the 89-day moving average, the upper edge of a declining channel since early 2023, and the Ichimoku cloud on the daily charts (at about 18900-19200) suggests the recent rally is nothing more than corrective. This follows a rebound from near a tough floor at the June low of 18045.

Hang Seng Index Daily Chart

Chart Created Using TradingView

A decisive break above would raise the chances that the Hong Kong benchmark index was finally beginning to flex muscles after underperforming since early 2023. Indeed, such a break would heighten the chances of the index clearing the few-times tested resistance at 20155. On the downside, a failure to hold above last month’s low of 17575 could open the way initially toward the November 2022 low of 16830.

Kospi Weekly Chart

Chart Created Using TradingView

Kospi: May have peaked for now

A double top at major resistance and a lower low created in August raises the odds that Kospi’s rally this year could be reversing. A break below the crucial support at the July low of 2515 has triggered a minor double top (the June and August highs), potentially opening the door toward 2380. Stronger support is at the March low of 2350 – Kospi needs to hold above this support for the rebound from late last year to resume. The index has faced stiff converged resistance on the 89-week moving average, a horizontal trendline since 2022, around the upper edge of the Ichimoku cloud on the weekly charts.

FTSE Straits Times Index Monthly Chart

Chart Created Using TradingView

FTSE Straits Times Index: Still struggling to find a direction

Singapore’s FTSE Straits Times Index continues to trend within a narrow range of 3000-3400. Barring the brief low of 2968 created in Q4-2022, the index appears to have set a solid low around 2950-3050, which includes the 200-week moving average. As mentioned in the previous update, a break below is by no means imminent – it could well rebound as it has done multiple times since 2021. See “Asian Indices Feel the Heat of Rising Yields: Hang Seng, Kospi, Straits Times Index Setups,” published August 22.

However, any break below could raise the odds that the post-Covid rebound is over, putting the index back within a very broad range of 2200-3500 (including the 2020 low and the 2022 high). For the bullishness to resume, a crack above resistance at the 2022 high would be needed. Until then, the path of least resistance remains sideways to down.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.