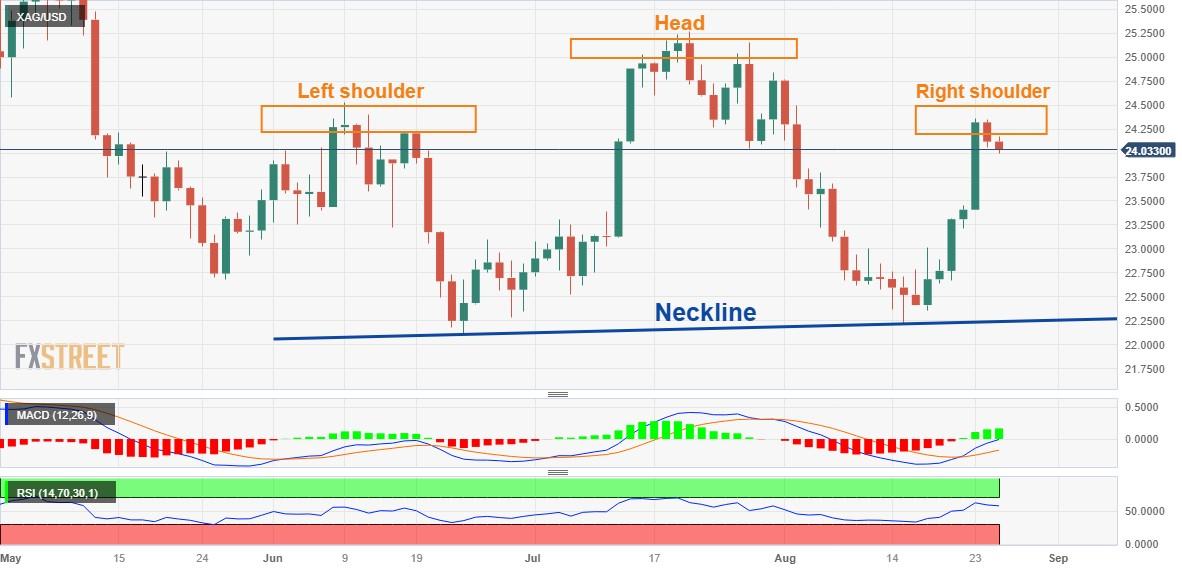

XAG/USD hovers above $24.00; bearish head and shoulders in the making

- Silver moves away from a multi-week high set on Wednesday, albeit lacks follow-through.

- A convincing break below the $23.80 confluence should pave the way for deeper losses.

- Bulls might now wait for a move beyond the $24.35 region before placing aggressive bets.

Silver remains under some selling pressure for the second successive day on Friday and retreats further from a three-week top, around the $24.35 region touched on Wednesday. The white metal remains depressed through the early part of the European session and currently trades around the $24.00 round-figure mark, down just over 0.10% for the day.

The XAG/USD, however, manages to hold above the $23.85-$23.80 confluence, comprising the 23.6% Fibonacci retracement level of the recent rally from the monthly low and the 200-period Simple Moving Average (SMA) on the 4-hour chart. The said area could act as a pivotal point for intraday traders and help limit any further decline, against the backdrop of positive technical indicators on 4-hour/daily charts.

A sustained break below, however, might prompt some technical selling and drag the XAG/USD towards the 38.2% Fibo. level, around the $23.55 region. This is closely followed by another confluence support near the $23.40 area, comprising the 200-day SMA and the 50% Fibo. level, which if broken decisively might shift the near-term bias in favour of bearish traders and pave the way for some meaningful downside.

Silver 4-hour chart

Zooming out to the daily chart, the recent price action witnessed since early June seems to constitute the formation of a bearish head and shoulders pattern on the daily chart. The pattern, however, will be confirmed on a sustained break below the neckline support, around the $22.20-$22.10 region.

XAG/USD daily chart

In the meantime, bulls need to wait for some follow-through buying beyond the overnight swing high, around the $24.35 area, before placing fresh bets. The XAG/USD might then aim to surpass the $24.55-$24.60 intermediate hurdle and aim to reclaim the $25.00 psychological mark before climbing to the $25.25 zone, or the July monthly swing high. Some follow-through buying should pave the way for a rise to the $26.00 mark.

Technical levels to watch

Comments are closed.