Finance Minister Suzuki Sticks to Script as EUR/JPY, USD/JPY Advance

USD/JPY, EUR/JPY FORECAST:

- Japanese GDP Posts Upside Surprise but the Yen Continues to Slide.

- Finance Minister Suzuki Offers Nothing New When Quizzed on Potential FX Intervention, but Top FX Diplomat Kanda Says He is Monitoring the Situation Closely.

- IG Client Sentiment Shows Retail Traders Extremely Bearish on Both USD/JPY and EUR/JPY.

- To Learn More About Price Action,Chart PatternsandMoving Averages, Check out theDailyFX Education Series.

Recommended by Zain Vawda

Get Your Free JPY Forecast

MOST READ: BoE Faces Pressure Following Average Earnings Spike as Unemployment Rises, GBP/USD Bid

The Yen continued to slide against the Greenback and the Euro this morning despite a positive GDP print and comments from Finance Minister Suzuki around FX intervention. The comments from Finance Minister Suzuki sounded all too familiar as if from a script, having heard the exact same words/phrases prior to last year's intervention and this year as well.

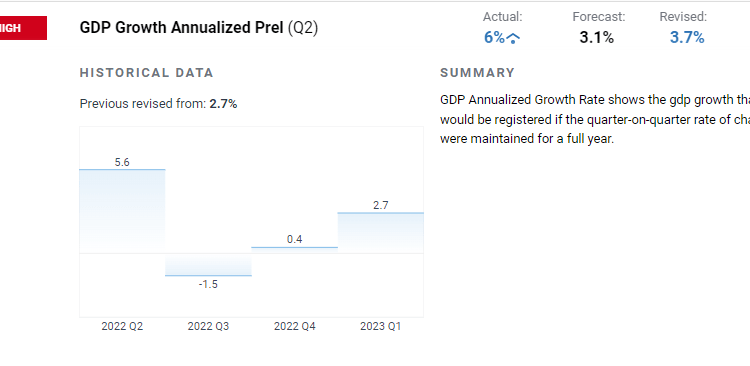

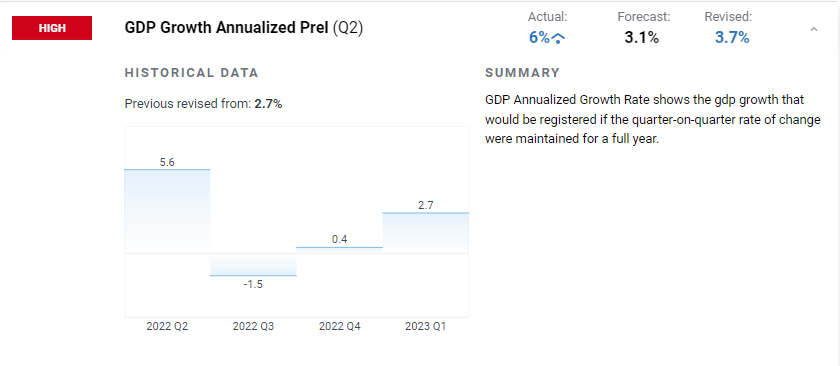

JAPAN FINANCE MINISTER ON INTERVENTION AND GDP DATA

The positive GDP data out from Japan this morning means the worlds 3rd largest economy has now posted 3 consecutive quarters of expansion. The YoY print annualized came in at 6% in Q2 compared to annualized growth of 2.7% in Q1.

Finance Minister Suzuki stated that it remains key for currency markets to reflect the underlying fundamentals and move in a stable fashion. Minister Suzuki reiterated the ongoing rhetoric that no FX levels are being targeted but rather speculative and undesirable moves may result in intervention. Deputy Finance Minister and Top Currency Diplomat Masato Kanda stated he is monitoring the markets with a sense of urgency and would take appropriate steps against excessive currency moves.

Source: DailyFX

ZEW sentiment data came out earlier as well with the sentiment index coming in positive, but the current conditions remain a concern. A rare positive here which could help EUR/JPY and USD/JPY moving forward is that survey respondents by and large do not anticipate any further rate hikes in the Eurozone or the United States.

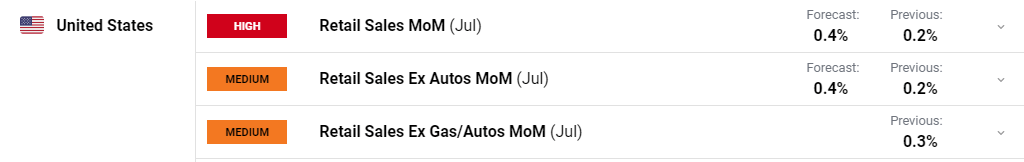

Later today we do have US retail sales data and some Fed speakers which could have an impact on USDJPY as it continues to advance above the key 145.00 handle.

For all market-moving economic releases and events, see the DailyFX Calendar

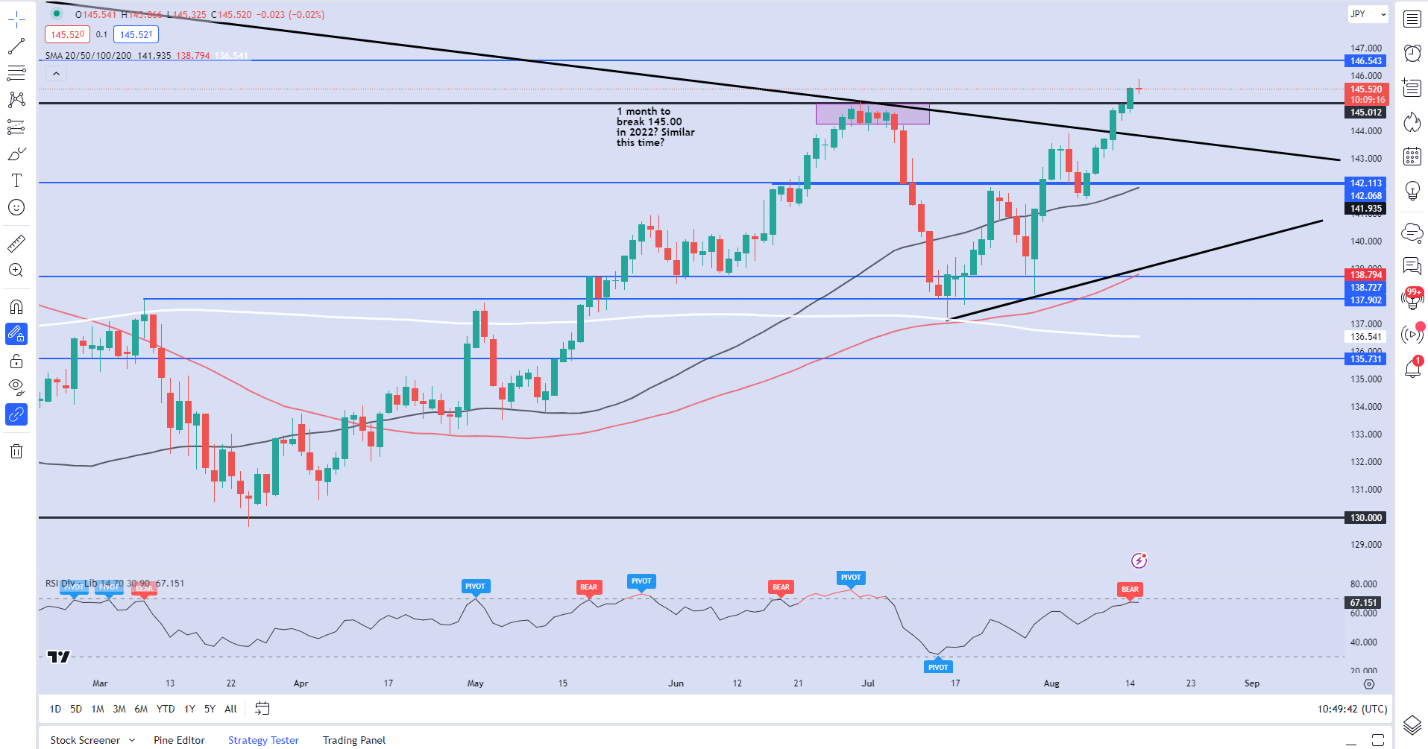

TECHNICAL OUTLOOK AND FINAL THOUGHTS

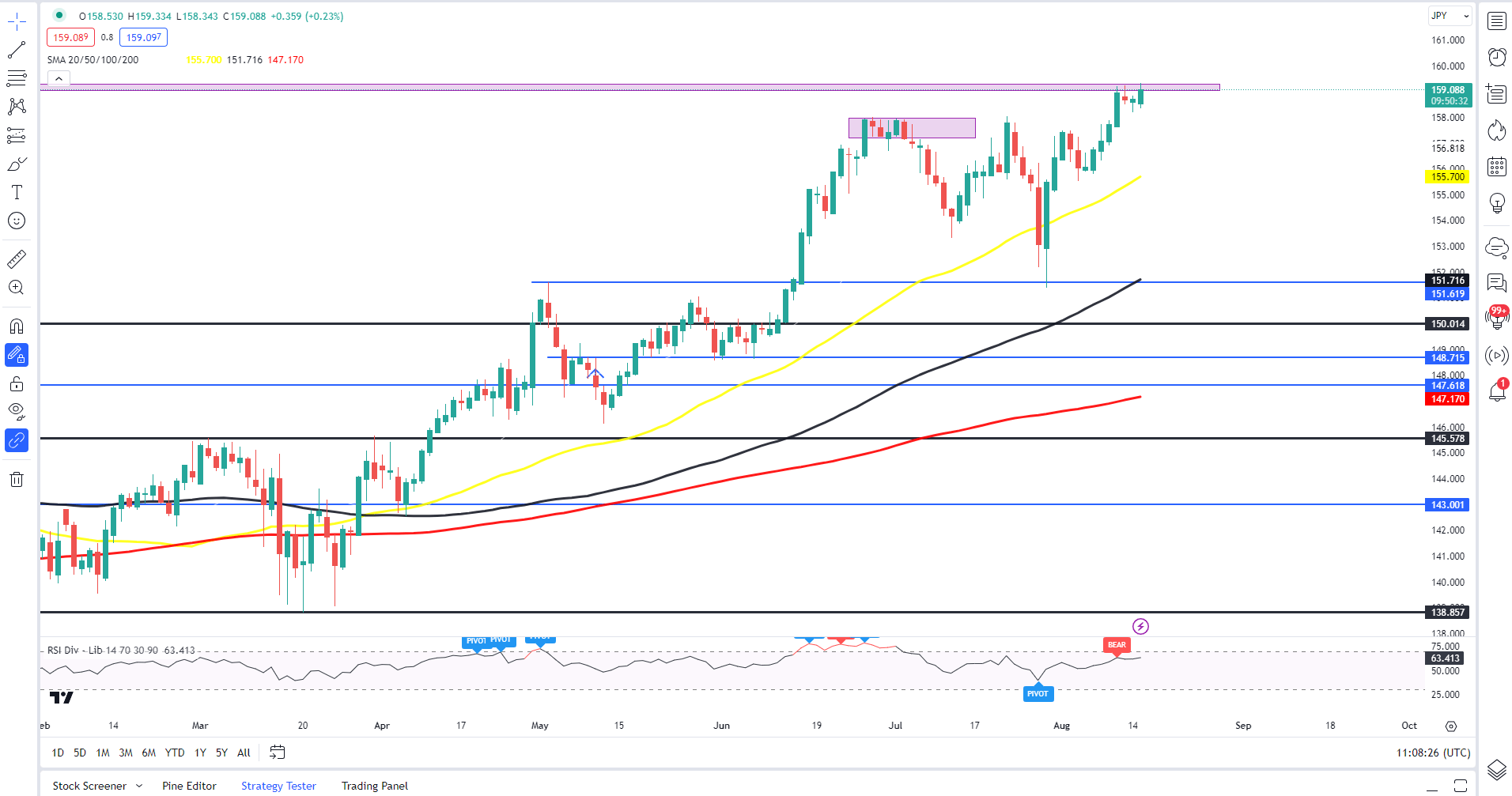

USDJPY is on a tear at the minute pushing toward the resistance area around 146.50. There has been a slight pullback as we approach the US open with the Dollar Index retreating from the key confluence area and 200-day MA. The question remains whether this is sustainable? There is support as well around the 102.30-102.10 area provided by the 50 and 100-day MAs which could help keep the Dollar supported should the index attempt to push lower.

For More Tips on How to Trade USD/JPY Get Your Free Guide Below

Recommended by Zain Vawda

How to Trade USD/JPY

As I have mentioned over the past couple of weeks, FX intervention from Japanese authorities remains a possibility. The issue is there is no warning or sign as to when this may occur with Japanese authorities saying one thing but doing the complete opposite of late. Barring intervention, I honestly don’t see any other reason to expect a significant push to the downside with any push lower likely to provide bulls with another opportunity to join the trend.

USD/JPY Daily Chart – August 15, 2023

Source: TradingView

EURJPY

EURJPY has finally rallied into the 159.00 handle before a slight pullback and now eyeing a break higher toward the key psychological 160.00 mark. Looking beyond the 160.00 handle and there isn’t much in terms of significant resistance holding the pair back from testing multi-year highs around the 170.00. Similar to USDJPY however, I do expect the Japanese authorities to intervene should we see an aggressive move above the 160.00.

EUR/JPY Daily Chart – August 15, 2023

Source: TradingView

IG CLIENT SENTIMENT

IGCSshows retail traders are 77% Net-Short on EURJPY.

For a Full Breakdown on Client Sentiment Including Daily and Weekly Changes Get Your Free Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 4% | 1% | 2% |

| Weekly | 51% | 9% | 16% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.