Dollar Index (DXY) Eyes Acceptance Above 100-Day MA, USD/CHF Ticks Higher

DOLLAR INDEX, USD/CHF PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free USD Forecast

Most Read: US Dollar Forecast: ‘Soft Landing’ Narrative Gains Traction Post FOMC

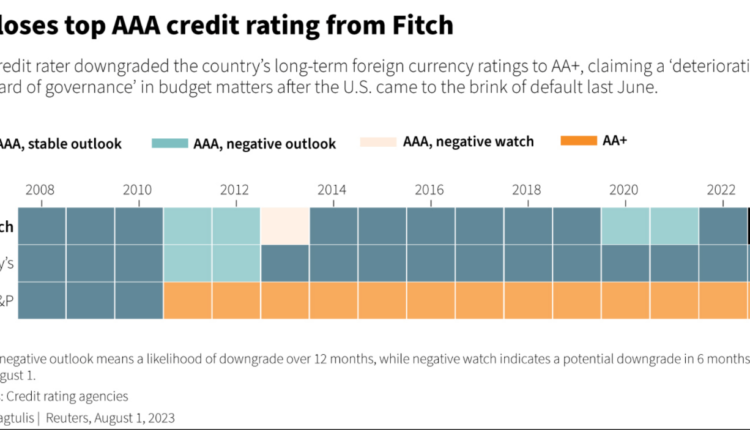

US DOLLAR, FITCH RATINGS DOWNGRADE

The US Dollar and Dollar Index (DXY) faced a slight pullback as yesterday's US session began winding down as Fitch Ratings Agency downgraded the US to AA+ from AAA, the second major ratings agency to do so. The immediate slide in risk assets and the Dollar Index appears to be limited however, with history telling us this could merely be a blip with risk assets appreciating in the months and years following the previous downgrade to AA+ by S&P in 2011. Important to note that S&P have maintained that rating since with this the first time that both ratings agencies have the US at AA+ since the 2008 financial crisis.

Source: Refinitiv

The White House as well as US Treasury Secretary Janet Yellen appeared to disagree with the assessment with Yellen calling the decision arbitrary and based on outdated data. However, a closer look at delinquency rates in the US show 6 straight quarterly increases, the longest streak since 2008 with total credit card debt in the US about to cross the $1 trillion mark for the first time. Credit card balances are at a high of $7300 while median household savings are resting at $5300, which begs the question “Are US consumers using credit cards to stave off the rising costs of goods and services?” The Fitch statement outlined the repeated debt-limit and political standoffs as a key point as well as rising Government debt levels with debt to GDP expected to widen and not contract moving forward. Have markets been too optimistic around the health of the US economy?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/CHF OUTLOOK

The Swiss Franc has lost some ground of late as the greenback continues its rise from YTD lows. This morning did bring some data from Switzerland as we had the manufacturing PMI which continued a recent trend globally indicating a significant slowdown. The print came in at 38.5 below the previous 44.9 print as well as the forecasted figure of 44. Consumer confidence data also missed estimates but did improve ever so slightly from the previous print of -29.6. Looking more closely at consumer sentiment and outlook on the economic situation showed signs of a sharp improvement coming in at -6.8 compared to the previous print of -17.7. However major purchases remain an area of concern and deteriorated further as consumers are likely to prioritize necessities at present.

Swiss inflation data is due out tomorrow and could continue a positive trend for the SNB who have seen 4 consecutive months of declines since the January peak around 3.4%. A further drop is forecasted with analysts eyeing a print of 1.6 which could in theory work against the Swiss Franc and see USDCHF continue to rise. Of course, developments around the USD will be key as well and could have a bigger impact on where USDCHF heads next.

ECONOMIC CALENDAR

There is not a lot left on the Calendar today in terms of event risk with tomorrow and Friday bringing some high impact risk events. Of course, Friday’s jobs numbers and NFP report will be key and so will Services PMI out of the US following an excellent jump last month.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

US DOLLAR

Looking at the Dollar Index and the rally has continued this morning but faces a significant area of dynamic support thanks to the 50-day and 100-day Mas resting at 102.36 and 102.45 respectively. A break above here would open up a retest of the 200-day MA and potentially the top of the channel. On the downside immediate support rests at a key resistance turned support area around the 102.00 handle and could prove pivotal to the Dollar Index’s next move.

DXY Daily Chart

Source: TradingView, prepared by Zain Vawda

USD/CHF

Looking at the technical picture on USDCHF and we have bounced off the 2011 lows around the 0.8500 handle with resistance at the 0.8760 mark being tested at present. This was a swing low from January 21 before the expansive upside rally began before declining for the majority of 2023.

On the daily timeframe we are seeing the RSI (4) hovering in overbought territory as well which lines up with the IG Client Sentiment outlook. Looking closely at the IG client sentiment data and we can see that retail traders are currently netLONGonUSDCHFwith81%of traders holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment meaning we could see USDCHF prices continue to decline following a short upside rally.

USDCHF Daily Chart

Source: TradingView, prepared by Zain Vawda

| Change in | Longs | Shorts | OI |

| Daily | -3% | 20% | 0% |

| Weekly | -15% | 16% | -11% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.