RBA Minutes Unable to Prevent Thinning Aussie Dollar

AUD/USD ANALYSIS & TALKING POINTS

- RBA Minutes slightly hawkish yet AUD extends selloff.

- US retail sales under the spotlight later today.

- Long wick could lead to further AUD weakness.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar stays depressed after Chinese GDP data yesterday but managed to claw back some lost gains immediately after the RBA Minutes were released. The prior Reserve Bank of Australia (RBA) interest rate announcement resulted in a rate pause to review both local and external factors impacting the economy before reassessing the path forward. The Minutes revealed the decision was not unanimous with many in favor of a 25bps hike; however, the door was left open for future monetary policy tightening. Money markets currently expect another 25bps hike by year end and while the RBA Minutes did not change the markets views, emphasis will remain on the tight labor market and inflationary pressures.

There has been a steady long-term decline by the Aussie dollar against the greenback since February and fears of a slowing Chinese economy has been a key contributor barring US factors. I believe any positivity from China in terms of fiscal and monetary stimulus could have a greater impact on AUD upside than the already priced in China slowdown.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

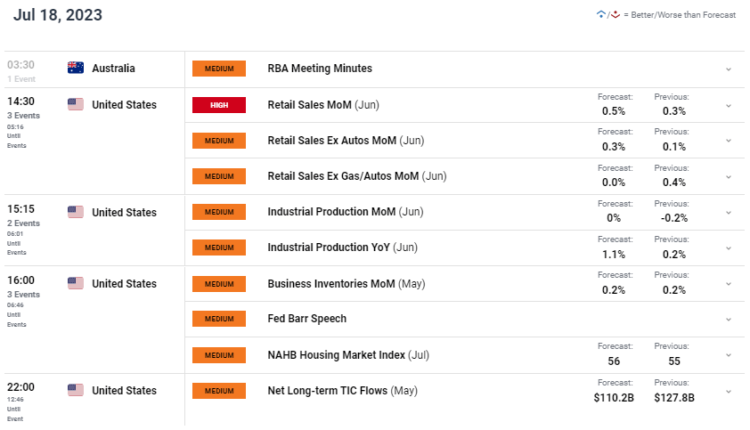

Later today, US retail sales data will dominate headlines (see economic calendar below) and is projected to push higher in June. Industrial production follows a similar estimation and may support the US dollar should actual data fall in line.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action has been on the backfoot ever since the rejection at trendline resistance (black) last week with bears now looking to pierce below the 0.6800 psychological handle once more. That being said, both short and long-term momentum remains in favor of bulls due to price action trading above the 50 and 200-day moving averages respectively.

Currently, today’s daily candle presents with a long upper wick and should it close in this fashion, it could be a technical indication to further downside to come for AUD/USD.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

Key resistance levels:

- 0.6900

- 0.6856/ Trendline resistance

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently net LONG on AUD/USD, with 52% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.