British Pound Q3 Technical Forecast

British Pound Technical Forecast: GBP/USD, EUR/GBP, and GBP/JPY

As we enter the third quarter the outlook for the British Pound looks mixed. While GBP should be supported by a growing interest rate differential against a range of currencies, investors will shun Sterling if recessionary fears grow. There are opportunities for a few GBP pairs with GBP/USD, EUR/GBP, and GBP/JPY all offering potential trade setups.

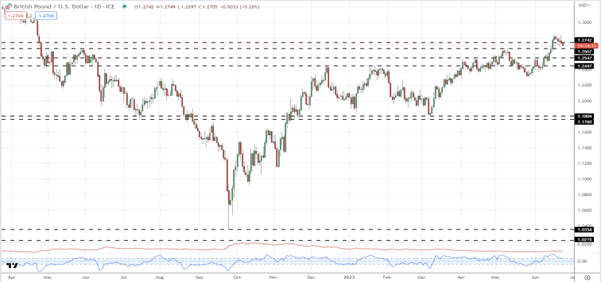

GBP/USD – Look for Pullbacks

Cable remains in an uptrend with the pair printing a series of higher lows and higher highs since late September last year. While most of the move higher from the spike low at 1.0354 happened in 2022, this year the move is slightly more predictable. Any sell-off will be met by support all the way down to the 1.2447 area, while there is little in the way of resistance before 1.3000 comes into view. Cable may look to trade in this 1.2447 to 1.3000 range in the coming weeks, giving range traders opportunities along the way.

Recommended by Nick Cawley

The Fundamentals of Range Trading

GBP/USD Daily Price Chart

EUR/GBP – Another Leg Lower?

Going into Q3, EUR/GBP is trying to pare its recent losses after the pair made a fresh 10-month low in mid-June. The trend lower over the last two months remains in place with lower highs and lower lows made on a regular basis. EUR/GBP is struggling to hold support just above 0.8500 and a confirmed break lower would leave 0.8340 as the next level of horizontal support. The old support level on either side of 0.8720 will act as a reasonable level of resistance in the coming weeks.

EUR/GBP Daily Price Chart

Recommended by Nick Cawley

Trading Forex News: The Strategy

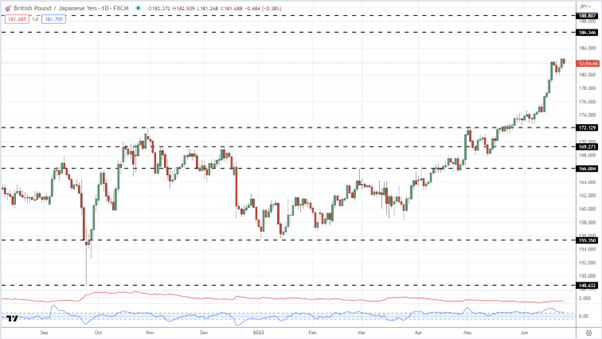

GBP/JPY – Entering Overbought Territory?

One of the big FX winners of Q2 has been long GBP/JPY. The pair is up 11% since the start of April and are currently trading at, or very close to, levels last seen in December 2015. The fundamental backdrop of a dovish Bank of Japan (BoJ) and an increasingly hawkish Bank of England (BoE) has fuelled the move to date, and this move may have more to run, but care needs to be taken. There is a bullish flag forming on the daily chart that suggests the path of least resistance is higher, but the BoJ has previous form when it comes to verbal currency intervention if they feel that the Yen is too weak. With volatility in the pair remaining high, any BoJ chatter could send GBP/JPY sharply lower, especially as the pair rallied from a low of 174 to hit a 182 high in just four days. Support is seen around 172.00 to 174.00 while 186.35 and 188.81 are prior levels of resistance that should be monitored.

GBP/JPY Daily Price Chart

All charts prepared using TradingView

Comments are closed.