XAG/USD breaks structure to the downside, bears motivated

- Silver bears are licking their lips at key structures.

- The 38.2% Fibo is playing its resistance role.

Silver shot up in a correction on Friday with a high of $22.844 from $22.3474 the low. The bulls are correcting the week's sell-off into month's end. The focus is on the Federal Reserve as data continues to offer mixed messages. The Federal Reserve's preferred inflation gauge rose 0.3% MoM, in line with forecasts and below 0.4% in April while the annual core rate slowed to 4.6% and the headline PCE rate reached the lowest in nearly two years.

This came in contrast to this week's firmer data, profit-taking has ensued as the following illustrates:

Silver weekly chart

We are seeing a classic rejection of the M-formations neckline followed by a bearish continuation to crack structure to the downside.

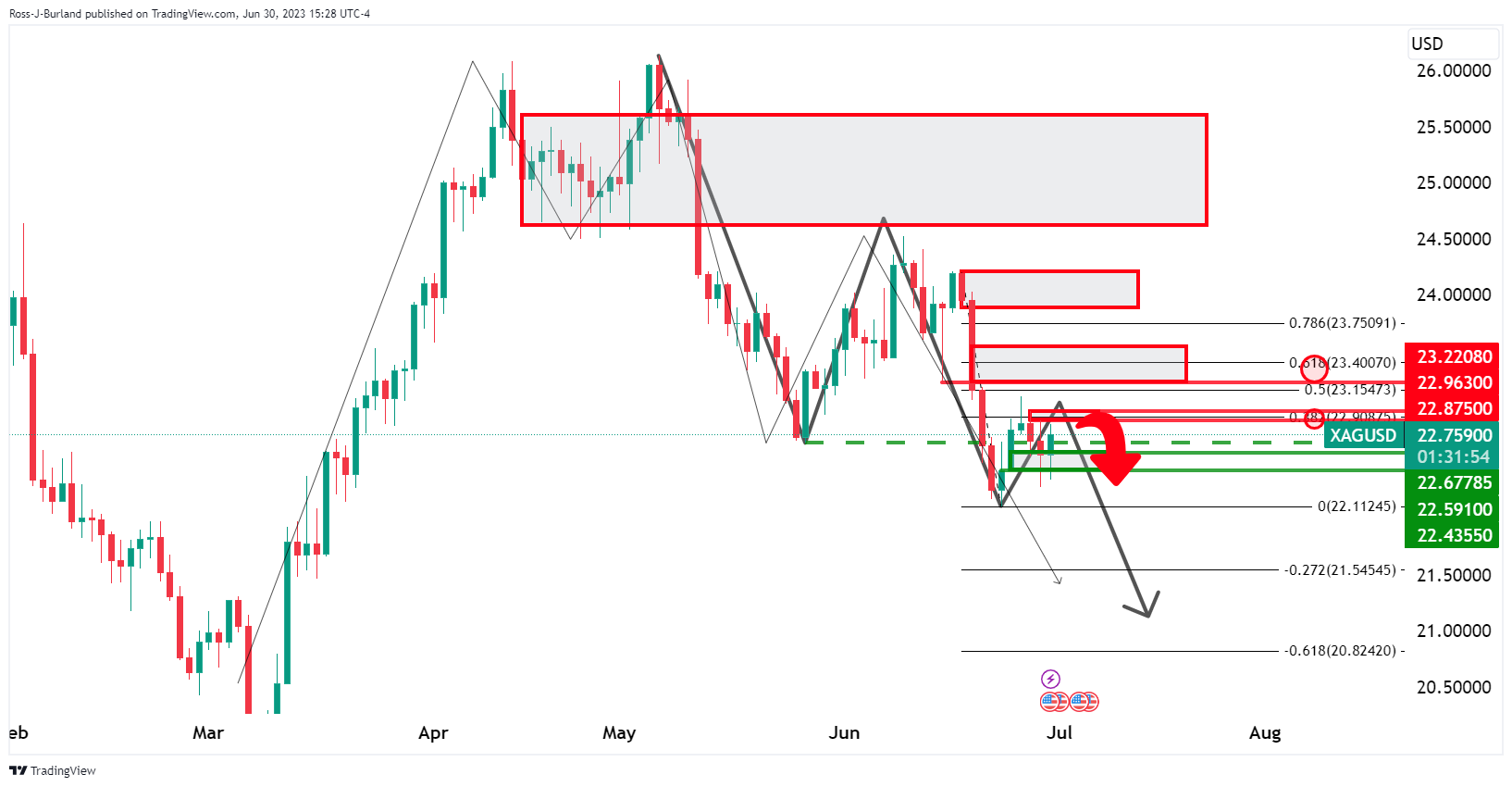

Silver daily chart

A bullish correction is in play to test a 38.2% Fibonacci that is so far acted as resistance. Bears are eyeing prospects of a downside continuation for the days ahead.

Comments are closed.