US Dollar (DXY) on the Backfoot Ahead of the US Jobs Report (NFP)

US Dollar Price, Chart, and Analysis

- US debt ceiling agreed and passes to President Biden to sign off.

- The US jobs market remains hot – next up is the closely followed NFP report.

Recommended by Nick Cawley

Trading Forex News: The Strategy

The US debt ceiling deal has passed through Congress and now just needs President Joe Biden’s signature to come into force, just a couple of days before the US government was expected to run out of money. Today’s agreement suspends the debt ceiling until Janaury1 2025 and should save around $1.5 trillion over the next 10 years. The multi-week debate over this debt ceiling caused US short-dated bill yields to rise sharply as investors priced in the very faint possibility of a US default. With these fears now in the rearview mirror, the pressure on these yields will be removed.

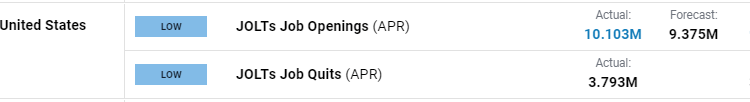

The US jobs market remains robust with companies still struggling to hire workers despite a slowing US economy. This week’s labor reports confirm Fed chair Powell’s view that the jobs market remains ‘very tight’ with the JOLTS and ADP releases this week both beating market consensus.

The latest US Jobs Report (NFPs) will hit the screens later today and will be closely parsed for any further evidence of labor market tightness. While the overall over the past year is lower, aside from a couple of outlier months, April’s report showed a small uptick while the unemployment rate stayed close to a multi-decade low. Today’s report is expected to show that 190k new jobs were added in May, although market consensus has been proved to be consistently low over the last year. Traders should also be aware of any market revisions to the headline number and to the average hourly earnings data.

The US dollar continues to slip lower with the move gaining extra momentum from recent commentary by two Federal Reserve voting members, Harker and Jefferson, who said that the Fed could keep interest rates on hold at this month’s FOMC meeting. Prior to these comments, the market was pricing in a roughly 65% chance of a 25bp hike on June 14. This probability has now slipped to just 27% with a 73% chance that the Fed will not hike rates.

The one-month US dollar rally has seemingly come to an end with the greenback now touching lows last seen over one week ago. The technical outlook remains mixed with the 200-dma and a prior level of resistance capping any move higher, while the 20- and 50-dmas are likely to provide support. Today’s NFP report may well move the US dollar but further moves, including any potential resistance and support breaks, will be dictated by the June FOMC meeting.

US Dollar Daily Price Chart – June 2, 2023

Chart via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.