Japanese Yen Price Setups: USD/JPY, GBP/JPY, EUR/JPY

USD/JPY, GBP/JPY and EUR/JPY Price Setups

Recommended by Richard Snow

Get Your Free JPY Forecast

Improved Risk Sentiment Weighs on the Yen

News of a possible agreement to raise the debt ceiling filtered through to markets yesterday evening and has continued to ease risk sentiment this morning. Updates from both sides of the US political system mentioned that a deal could be done by Sunday and that the framework for a deal has been established. With tensions over a US default subsiding, the Japanese yen appears vulnerable once more.

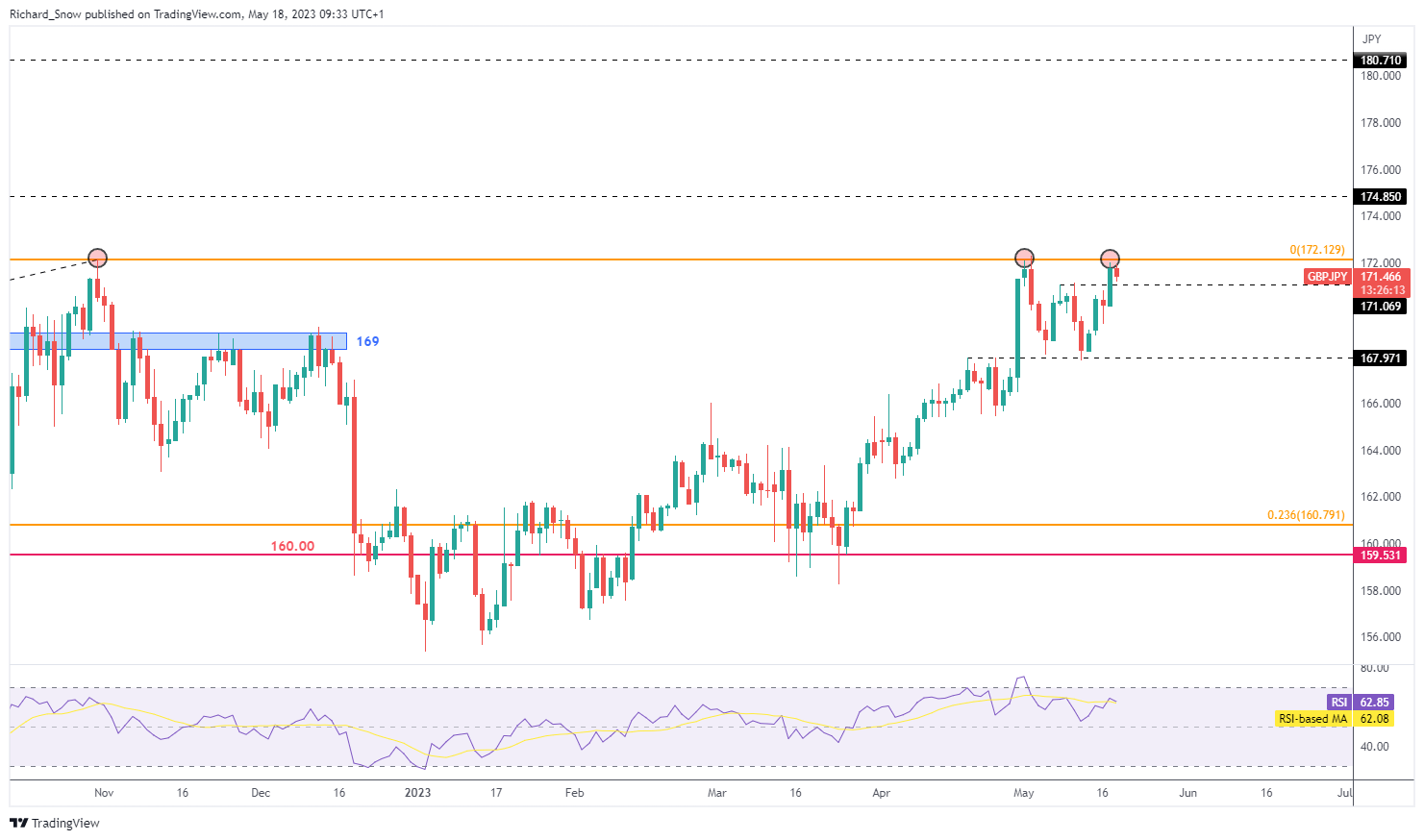

USD/JPY: Two Forces Combine, Sending the Pair Higher

Taking a look at USD/JPY ahead of Japanese inflation data tomorrow and a speech by Fed Chair Jerome Powell at an event titled ‘Perspectives of Monetary Policy’, it is clear to see the effect of both a stronger dollar and weaker yen at play. The dollar has ticked higher upon recent revelations of entrenched inflation expectations on the part of the US consumer and stubborn inflation. Rising US yields have also emboldened dollar bulls to return to the market after a period of heavy selling.

USD/JPY trades on the cusp of the upper side of the ascending channel which has, but for the prior false breakout, contained price action thus far. The pair now trades above the 200 SMA, flirting with the crucial 138.20 level of resistance – a level that has been approached multiple times this year without the needed momentum to trade above. However, given that this move involves both a weak yen and stronger dollar, momentum may be on the side of USD/JPY bulls. A lot will depend on whether an agreement can be reached on the debt ceiling this week.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

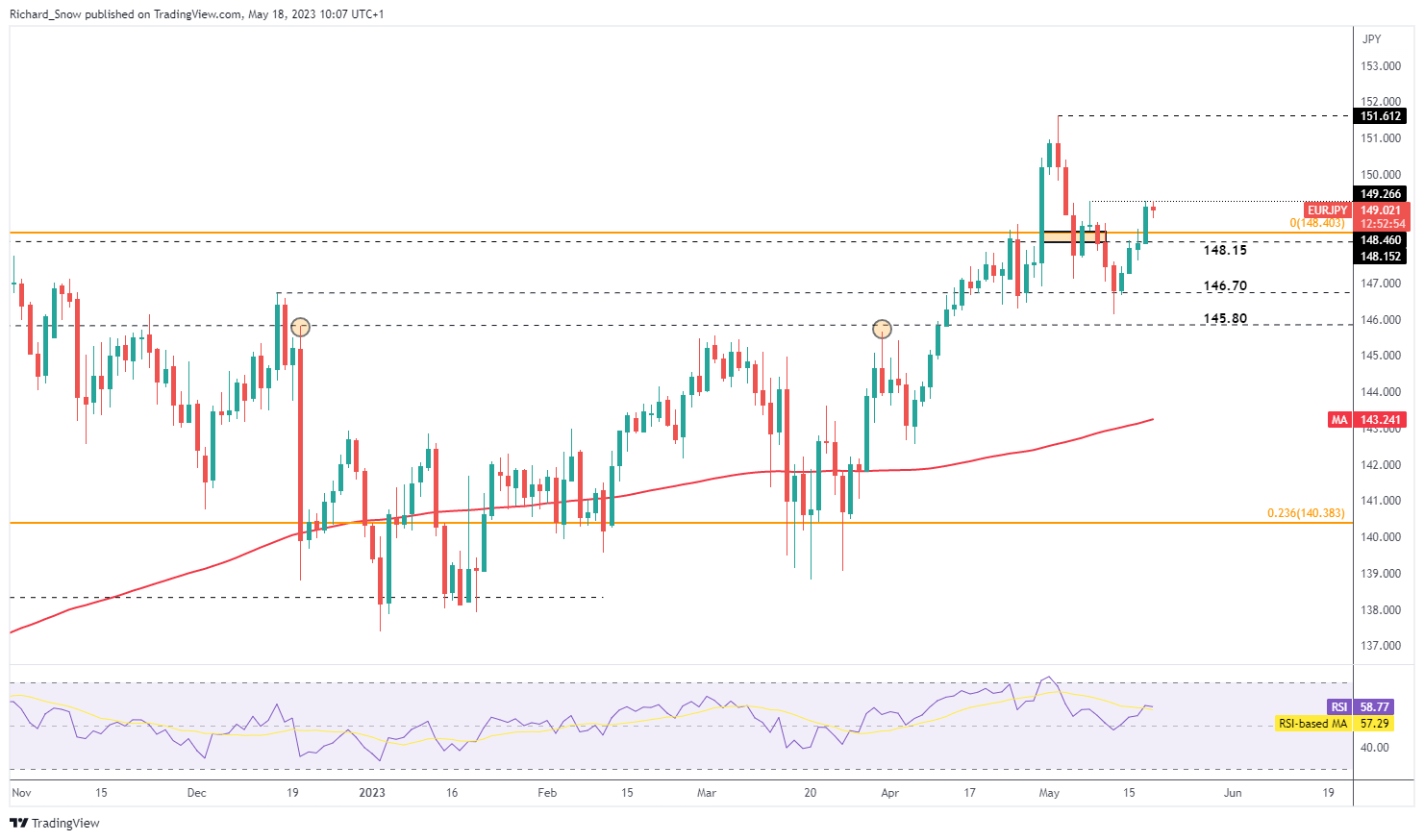

GBP/JPY: Regrouping Before Attempting Upside Break

GBP/JPY is at a similar juncture, testing resistance, but has shown indications of an intra-day pullback. The pair approaches the orange line which represents the high of the major 2020 to 2022 bullish advance which can be seen on the monthly chart along with further relevant levels of resistance should the pair clear 172.13. Early indications point towards a pullback towards 171.07 before another attempt at the key resistance level can be considered. The RSI has moved away from overbought territory, suggesting there is still some room left to the upside before a deeper pullback may be on the cards.

GBP/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

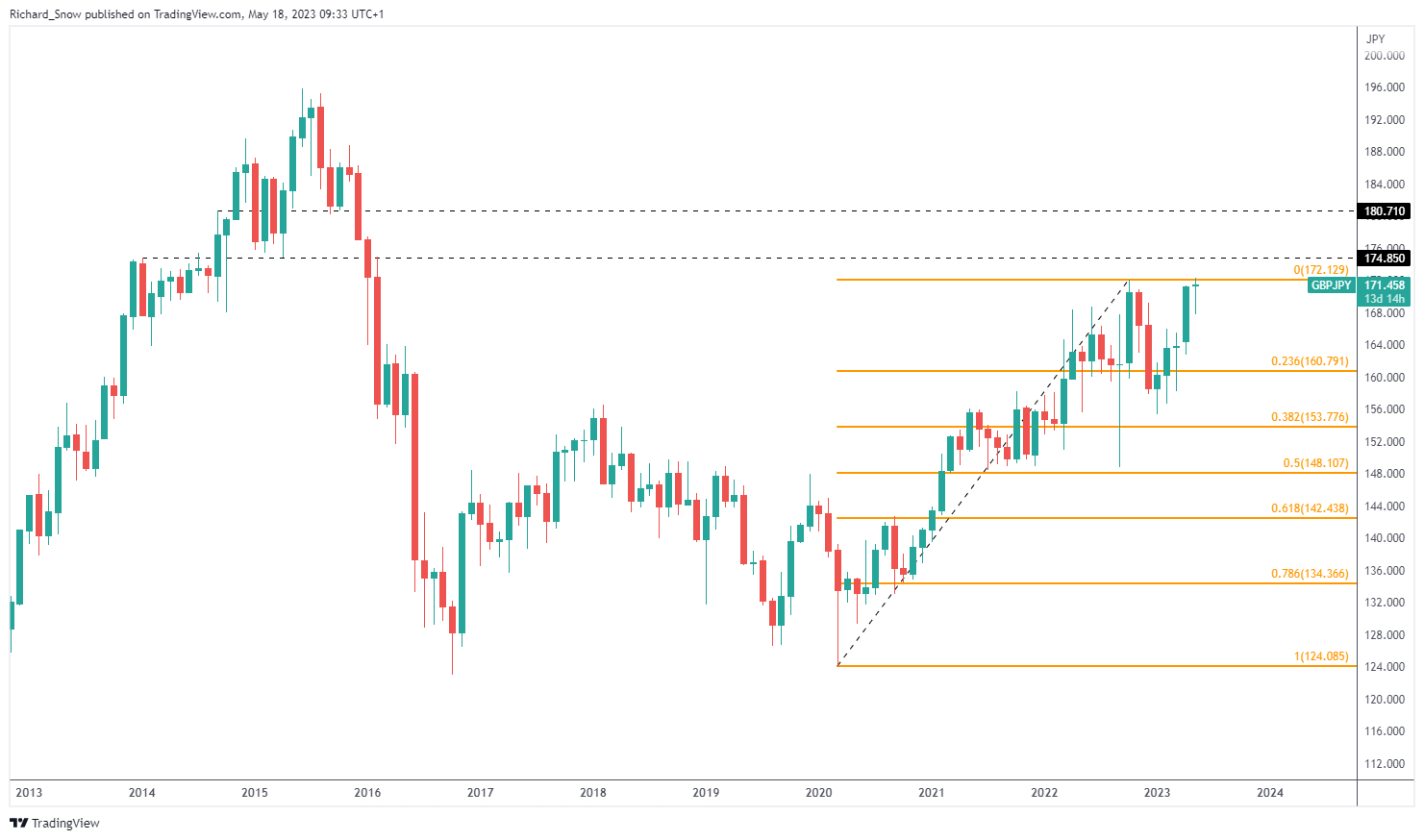

The monthly GBP/JPY chart shows the relevant Fibonacci levels for the major 2020 to 2022 move to the upside while also revealing the next levels of resistance should the pair break higher (174.85 and 180.70).

GBP/JPY Monthly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

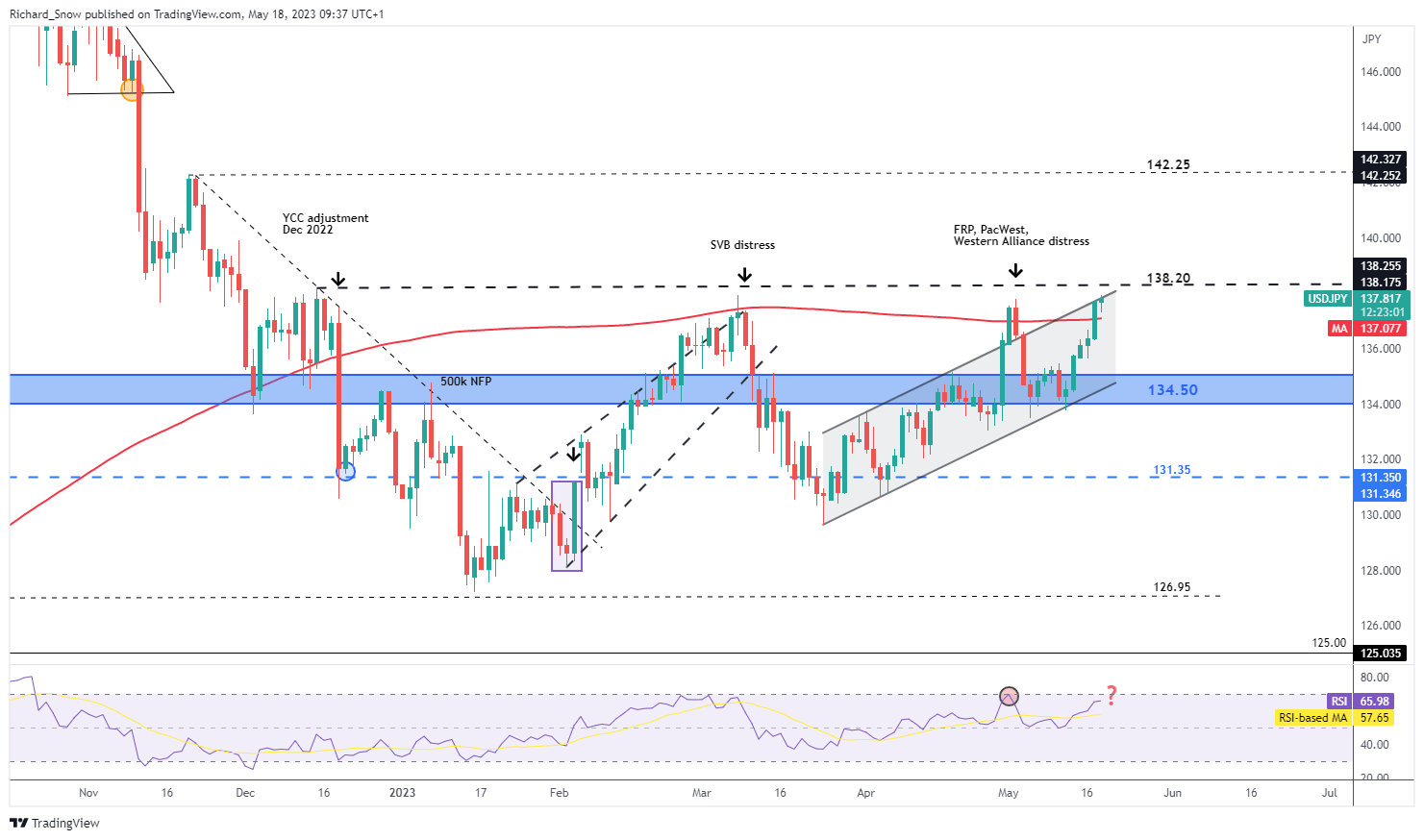

EUR/JPY: Bullish Move Capped by Prior Swing High

The EUR/JPY daily chart reveals a slowing of bullish momentum at the prior swing high of 149.27 in early European trade. The reemergence of US regional bank fears appears to have subsided, allowing the rising interest rate differential between the two currencies to pull the pair higher.

ECB officials are scheduled to speak on Thursday and Friday, looking to reiterate the need for further tightening to control inflation that is yet to see a meaningful decline, particularly on the core measure (inflation ex food and energy). The RSI eases away from overbought territory suggesting more room to the upside but 149.27 remains the tripwire for a bullish continuation.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

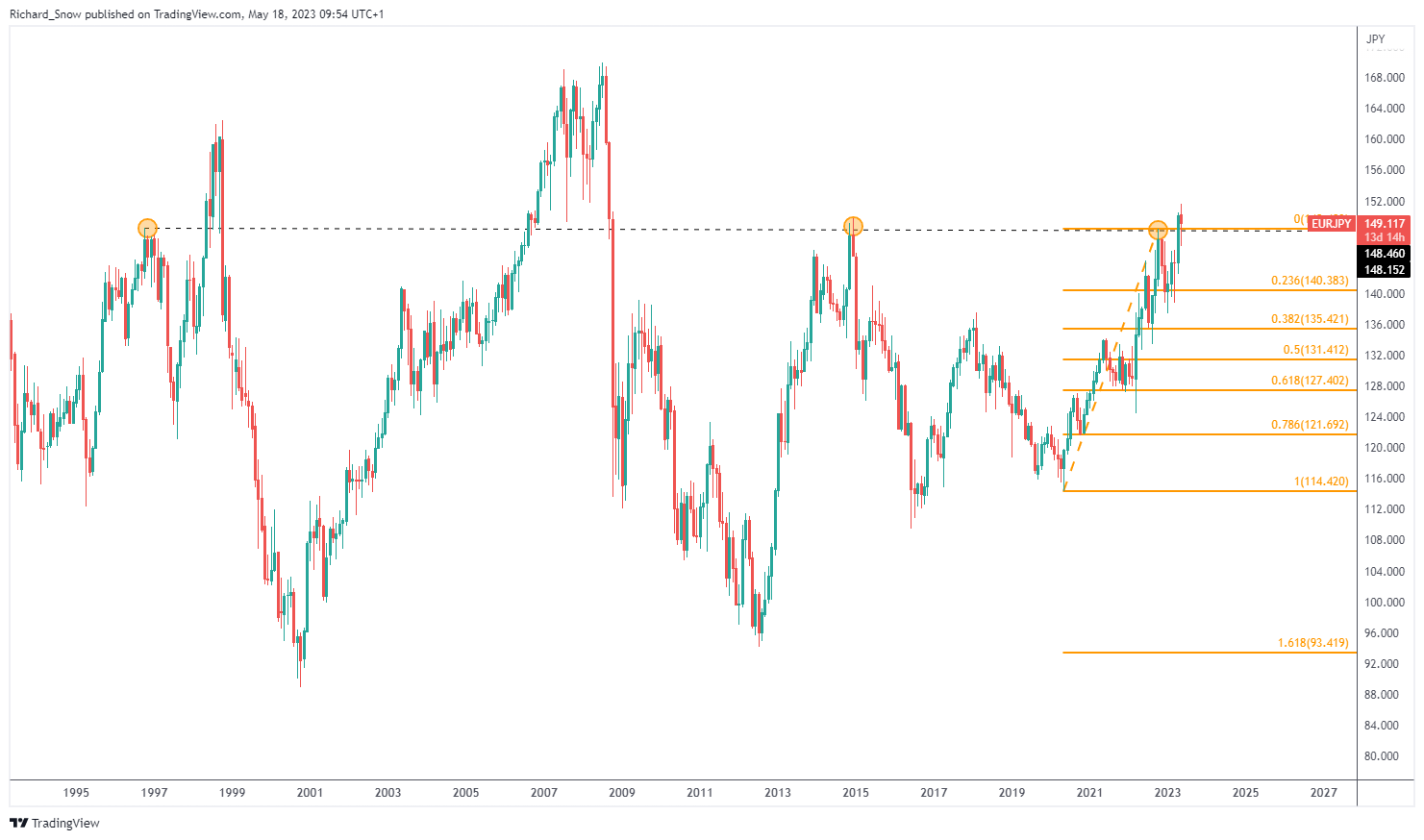

The monthly chart reveals a key long-term level of 148.46, a proven pivot point for major reversals in years gone by. For now, the pair trades above this level but its proximity provides a strong reminder that a sudden shift in sentiment has the potential to reverse the trajectory of the pair.

EUR/JPY Monthly Chart

Source: TradingView, prepared by Richard Snow

Given the monumental shift in risk sentiment and increasing interest rate differentials between the yen and other developed market currencies, it is difficult to make a case for a long yen bias – apart from a total shift to risk aversion which would see the yen return to favor.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.