China CPI rise slowest pace since Feb 2021, 0.1%, below expectations (0.3%)

The Consumer Price Index that is released by the National Bureau of Statistics of China has come out as follows:

- China Consumer Price Index (YoY) came in at 0.1%, below expectations (0.3%) in April. This was the slowest pace since February 2021.

- China Consumer Price Index (MoM) came in at -0.1%, below expectations (0%) in April.

- China Producer Price Index (YoY) came in at -3.6%, below expectations (-3.2%) in April.

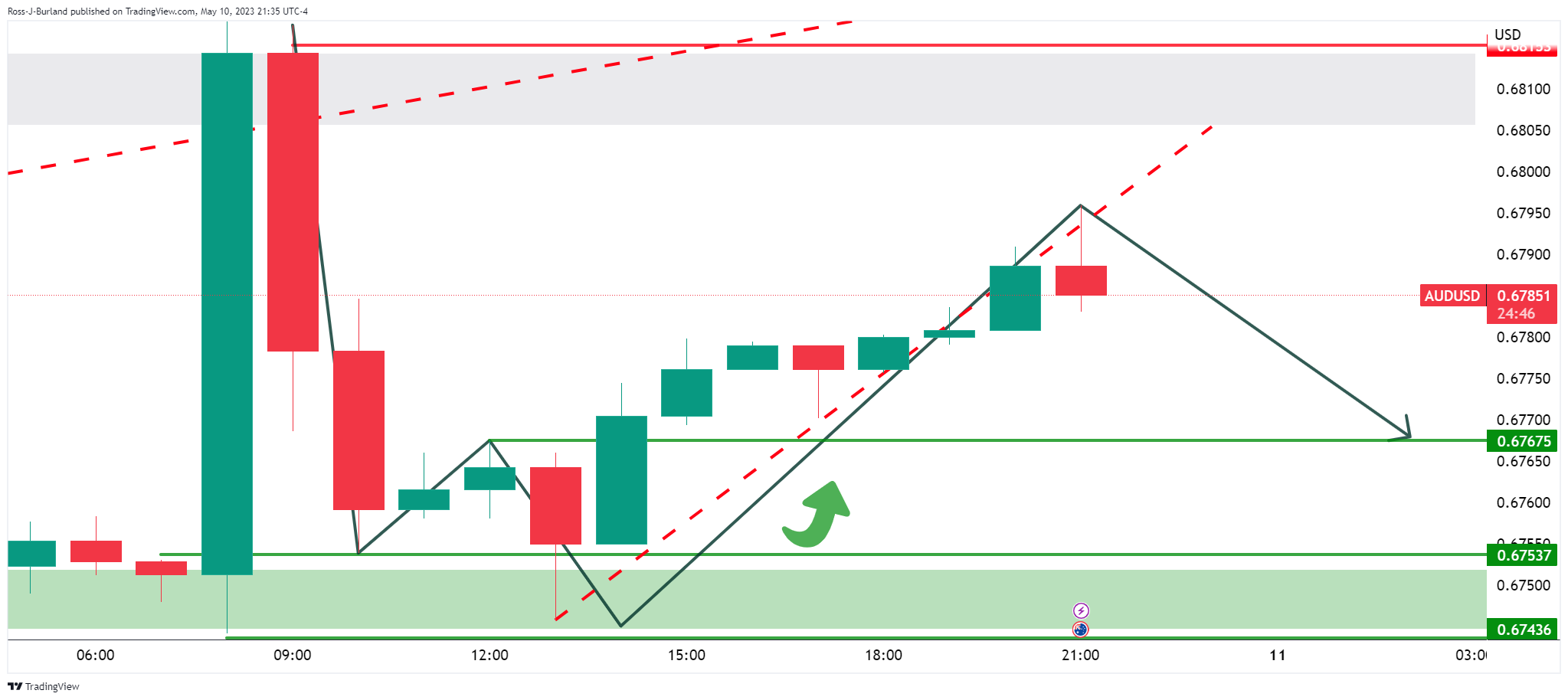

AUD/USD update

AUD/USD is trading at 0.6785 and is in the middle of the range of 0.670 and 0.6795 so far. The W-formation is a reversion pattern and there might be a correction to the downside.

On the 15-min chart, we have a potential topping formation place:

About the Consumer Price Index

The Consumer Price Index is released by the National Bureau of Statistics of China. It is a measure of retail price variations within a representative basket of goods and services. The result is a comprehensive summary of the results extracted from the urban consumer price index and rural consumer price index. The purchase power of the CNY is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A substantial consumer price index increase would indicate that inflation has become a destabilizing factor in the economy, potentially prompting The People’s Bank of China to tighten monetary policy and fiscal policy risk. Generally speaking, a high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

Comments are closed.