Euro Area Core Inflation Retreats as YoY Print Accelerates, EUR/USD Lower

EURO AREA CORE INFLATION FLASH KEY POINTS:

Euro Area Core Inflation Retreats as YoY Print Accelerates, EUR/USD Lower

Recommended by Zain Vawda

Get Your Free EUR Forecast

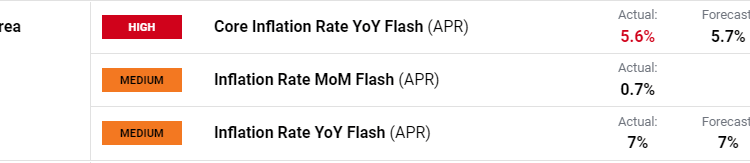

The core inflation rate in the Euro Area retreated slightly in April coming in at 5.6% in April down from last month’s print of 5.7%. The core CPI which excludes prices of energy, food, alcohol and tobacco went down 0.1% following a rise which started in June 2022 when core CPI rested at 3.7%. The core number remains uncomfortably high and despite signs of a slowdown in consumer spending and tightening conditions inflation remains stubborn.

For all market-moving economic releases and events, see the DailyFX Calendar

The YoY inflation rate did inch higher to 7.0 percent in April 2023, from March's 13-month low of 6.9 percent. Energy prices rebounded 2.5% vs -0.9% in March and the cost of services rose at a faster 5.2% vs 5.1% in March. On the other hand, inflation slowed for food, alcohol & tobacco to 13.6% vs 15.5% and non-energy industrial goods 6.2% vs 6.6%. On a monthly basis, consumer prices rose 0.7%, a third straight month of increase.

Recommended by Zain Vawda

Trading Forex News: The Strategy

THE ECB BANK LENDING SURVEY AND LOOK AHEAD

The ECB’s job is a tough one given the economic backdrop of the various countries in the Euro area. European Central Bank (ECB) policymakers have adopted a largely hawkish rhetoric of late ahead of this week’s meeting.

Earlier this morning we also had the ECB Bank Lending Survey which strengthened the belief of a 25bps hike at Thursday’s meeting. The lending survey showed substantial tightening by banks in regard to credit standards for both consumers and companies with Eurozone Banks reporting falling demand from companies for credit. Meanwhile consumers and households also felt the brunt of this as rejection rates increased and demand for home loans decreased strongly as consumers remain concerned about the overall confidence and the economic outlook.

The Bank Lending Survey at least provided some indication that we are seeing a more restrictive economy as the effects of rate hikes begin to filter through the economy. However, the slight uptick in the YoY inflation print may continue to play on the minds of ECB policymakers.

MARKET REACTION

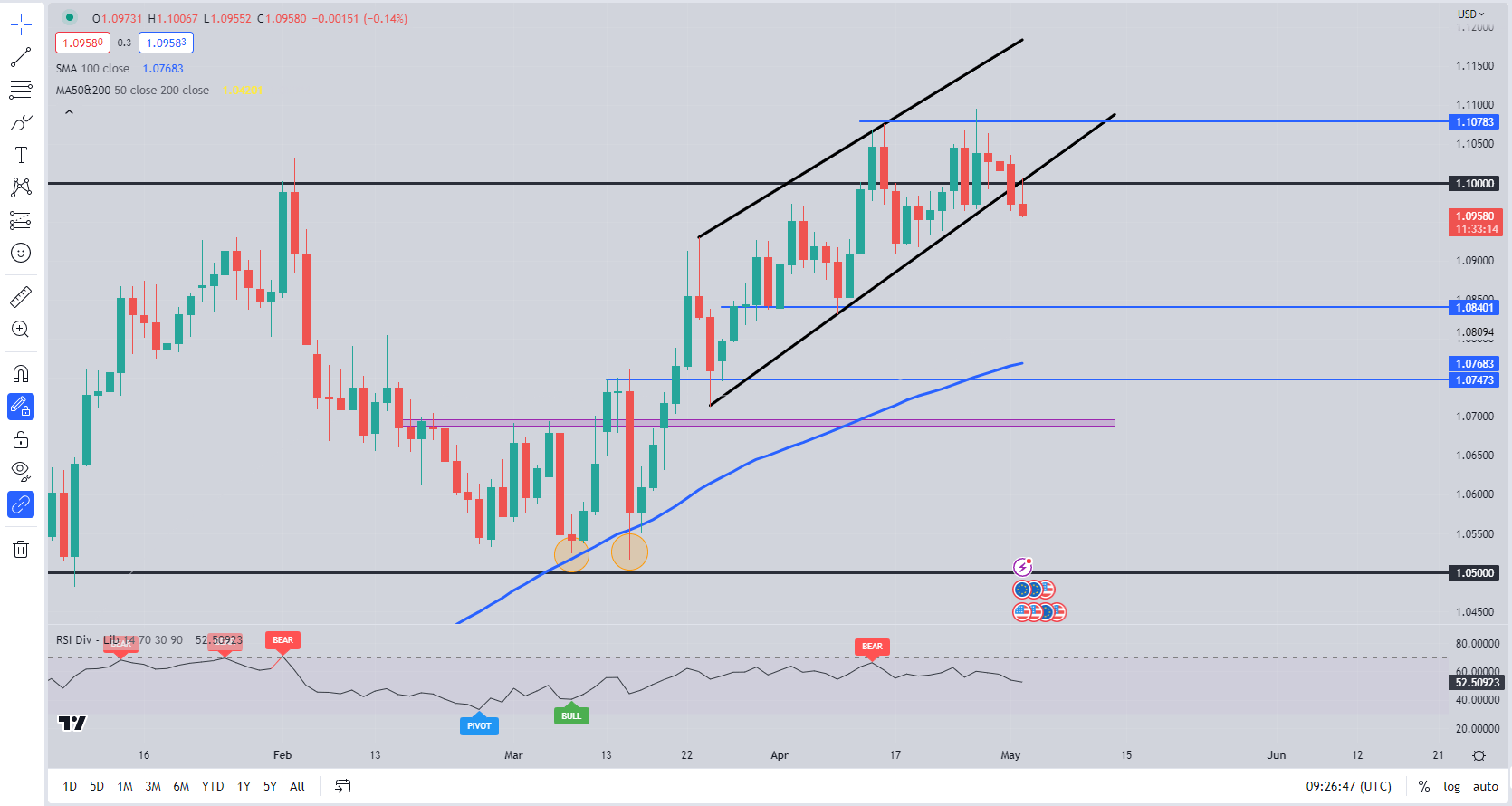

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 15 pip drop before recovering to trade relatively flat in the aftermath of the release. The pair has been hovering near the recent range low around 1.0950 in early European trade as the Euro faced some selling pressure following the release of the Bank Lending Survey this morning. The range between 1.0950 and 1.1050 could hold heading not tomorrows FOMC meeting.

The longer-term picture for EURUSD remains abit unclear at present as the technicals and fundamentals seem at odds with one another. The daily chart above shows a break of the ascending channel with further downside preferred from a technical standpoint. As much as the setup looks appealing the heavyweight fundamental data due this week may play a huge role in where EURUSD heads next. The forward guidance issued by both the Federal Reserve and the ECB could give more clarity on the rate hike paths for both Central Banks as dovish bets on the Fed have seen a fair amount of tempering of late.

Key Levels to Keep an Eye on:

Resistance Levels:

Support Levels:

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.