DAX 40, FTSE 100 May Stabilize Further as Retail Traders Boost Bearish Exposure

DAX 40, FTSE 100, Retail Trader Positioning, Technical Analysis – IGCS Equities Update

- DAX 40 and FTSE 100 have been stabilizing following recent losses

- Retail traders have responded by increasing their bearish exposure

- Could more gains be in store, or will the technical landscape prevail?

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

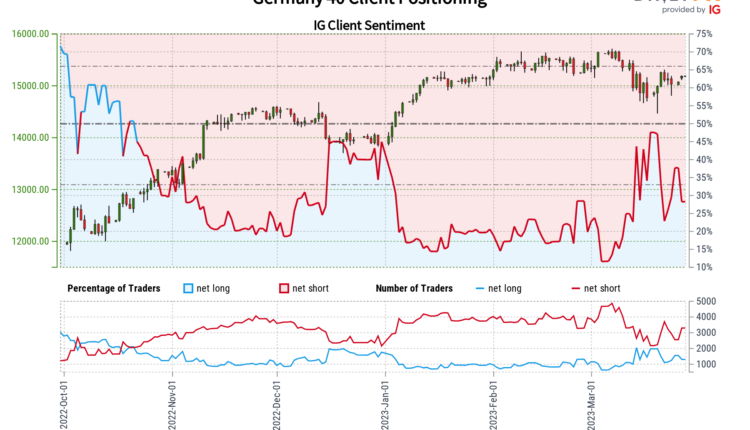

IG Client Sentiment (IGCS) appears to be showing that retail traders have recently been increasing their downside exposure in the DAX 40 and FTSE 100 indices. IGCS tends to function as a contrarian indicator. As such, if this trend in exposure continues growing, further gains might be in store for these European benchmark indices. But is the technical landscape matching this sentiment point of view?

DAX 40 Sentiment Outlook – Bullish

According to IGCS, about 28% of retail traders are net-long the DAX 40. Since most of them are biased to the downside, this suggests prices may continue rising down the road. Meanwhile, upside exposure decreased by 10.93% and 11.23% compared to yesterday and last week, respectively. With that in mind, the combination of current sentiment and recent changes offers a stronger bullish contrarian trading bias.

DAX 40 Technical Analysis

While IGCS points to a bullish perspective for the DAX, the technical landscape looks different. Recently, a bearish Death Cross formed between the 20- and 50-day Simple Moving Averages (SMAs), offering a cautious undertone. This followed the presence of negative RSI divergence, showing that upside momentum was fading. Downside follow-through has been somewhat lacking after prices reinforced support around 14800, which is the 23.6% Fibonacci retracement level. Breaking below exposes the 38.2% point at 14238.

Chart Created in Trading View

FTSE 100 Sentiment Outlook – Bullish

According to IGCS, about 58% of retail traders are net-long the FTSE 100. Since most traders are net-long, this hints prices may continue falling down the road. But, downside exposure has increased by 28.25% and 8.24% compared to yesterday and last week, respectively. With that in mind, recent changes in positioning warn that the price trend may soon reverse higher.

Recommended by Daniel Dubrovsky

Improve your trading with IG Client Sentiment Data

FTSE 100 Technical Analysis

Compared to the IGCS outlook, the FTSE 100 technical posture remains wobbly. Like the DAX, a bearish Death Cross is also in focus here, but this one appeared earlier. The index established immediate support around the midpoint of the Fibonacci retracement at 7361. Confirming a push lower places the focus on the 61.8% point at 7203. Otherwise, immediate resistance is the 38.2% level at 7518 before the 20-day SMA kicks in. The latter may reinstate the downside focus.

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.