$70 a Barrel Holds Firm as China Adds to Demand Concerns

OIL PRICE FORECAST:

- Oil Fails at the $70 Hurdle Before Sliding Further.

- President Putin Makes Rare Visit to Middle East as Saudi Arabia and Russia Reiterate Importance of OPEC+ Voluntary Cuts.

- Chinese Imports and Oil Demand from Refineries Falls.

- IG Client Sentiment Shows Traders are 87% Net-Long on WTI at Present.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices struggled in attempts to reclaim the $70 a barrel handle as it faced renewed selling pressure on renewed demand concerns. Having said that WTI was up more than 1% and did trade briefly above the $70 mark.

Recommended by Zain Vawda

Understanding the Core Fundamentals of Oil Trading

CHINESE IMPORTS INCREASE DEMAND CONCERNS

This shouldn’t be a new topic or a surprise for those of you who have been following my pieces on Oil of late. Chinese Oil imports have been discussed in depth with my original articles hinting at a buildup/replenishment of stockpiles by Chinese authorities. Given the mixed recovery in China the Asian nation still managed to surpass its previous records in term of Oil imports.

I had discussed the implications once the replenishment was complete and what impact a slowdown on imports from the World’s second largest economy. The month of November saw Oil imports fall 9.2% YoY in the first annual decline since April. There is also concern around slowing orders from independent refiners saw demand suffer. Given the ongoing concerns around the real estate and construction sectors ratings agency Moody’s put a downgrade warning on China’s credit rating. The Ratings Agency cited risks associated with the ongoing downsizing of the property sector. This if it continues into next year could hamper China’s recovery and also weigh on Oil demand.

PRESIDENT PUTIN VISITS SAUDI ARABIA AND UAE. OPEC+ MEMBERS COMMITTED TO CUTS

The OPEC+ meeting last week underwhelmed to say the least, with the voluntary cuts (begrudgingly agreed according to reports) failing to convince markets. This coupled with tensions in the Middle East saw Russian President Vladimir Putin make a rare trip to the Middle East. President Putin hasn’t traveled internationally since the war in Ukraine began but this week visited the UAE and Saudi Arabia. The two largest Oil exporters urged OPEC+ members to join an agreement on output cuts, the leaders citing the good of the global economy as a driving force for the move. Debatable or not the motives may be, however OPEC+ did get it right earlier in 2023 when they cut supply keeping Oil prices supported.

It is no secret that the bloc wishes o keep Oil prices steady above the $80 a barrel mark. The meetings in the Middle East concluded with both sides stressing the importance of their cooperation as well as the need for all participating countries to join the OPEC+ agreement and keep Oil prices steady. The biggest member of OPEC excluded from the cuts is Iran, the economy of which has been under various U.S. sanctions since 1979 after the seizure of the U.S. embassy in Tehran. Iran is boosting production and hopes to reach output of 3.6 million bpd by March 20 next year.

Recommended by Zain Vawda

How to Trade Oil

LOOKING AHEAD

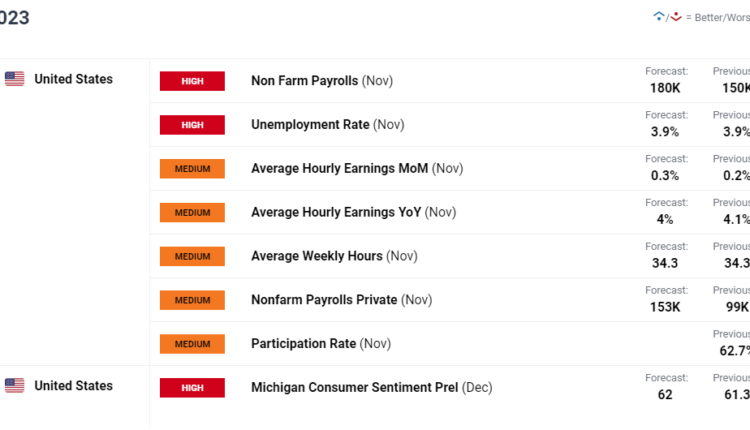

Looking to the rest of the week and US jobs data takes center stage tomorrow and has the potential to create a lot of volatility. This could have a knock-on effect on USD denominated Oil heading into a massive week of Central Bank meetings.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical perspective WTI remains vulnerable below the $70 a barrel mark with support resting around the $67 handle. This of course is a key area of support where we had printed a triple bottom pattern in May and June before the explosive move to the upside began.

A push to this level may face stiff buying pressure and could prove to be a bottom for Oil prices. Alternatively, a break back above the $70 a barrel mark immediate resistance rests at $72.15 and just above at the $73.06 handle.

WTI Crude Oil Daily Chart – December 7, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 87% of Traders are currently holding LONG positions. Given the contrarian view to client sentiment adopted here at DailyFX, does this mean we are destined to revisit the lows at the $67 mark?

For a more in-depth look at WTI/Oil Price sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -4% | -4% |

| Weekly | 21% | -7% | 17% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.