$1800 Back in Focus as Price Consolidates Following Selloff

GOLD (XAUUSD) PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

How to Trade Gold

MOST READ: Precious Metals Lose Shine After Powell; What’s Next for Gold and Silver?

Gold (XAU/USD) FUNDAMENTAL BACKDROP

Gold prices consolidated in the early part of the European session following yesterday’s selloff as $1800 psychological level comes back into focus. Gold is looking to extend its losing streak to a third straight day as a batch of US data and further commentary from Fed Chair Powell lies in wait.

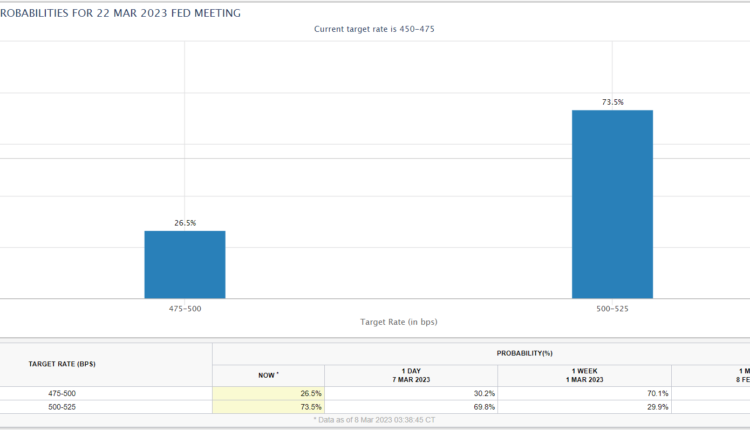

Gold has retreated from its multi week high price around $1856 as losses gained traction from Fed Chair Powell’s testimony before the Senate Committee in Washington DC. The key takeaways being a higher peak rate as well as potentially increasing the pace of hikes based on data. The probability of a 50bps rate hike is now at 73.5% for the Feds March meeting up from 29.9% a week ago.

Source: CME FedWatch Tool

If anything remains clear it is that markets are going to remain sensitive to incoming data from the US. Fed Members have until Friday to get any further commentary out ahead of the blackout period. Later today we have ADP employment, import and export data out of the US as well as continued testimony from Fed Chair Powell.

For all market-moving economic releases and events, see the DailyFX Calendar

Looking ahead, Friday’s NFP report as well as average hourly earnings will remain the main source of focus. Average hourly earnings continues to be a major headache for the Fed in its efforts to tame inflation while markets will be keen to see if last month’s NFP jobs report was a once off or will we see another massive print out of the US.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical perspective, Gold remains in a delicate position above the $1800 psychological level. From a Price Action and structure standpoint on the daily timeframe we remain bullish above the $1800 dollar mark which lines up with 100-day MA.

Yesterday’s daily candle did close as a marubozu candle with little to no wick, a sign of the bearish momentum evident in the precious metal. A break and daily candle close below the $1800 mark could open up a retest of the 200-day MA resting around the $1775 level, while a move higher has a lot of resistance areas to contend with $1825 and $1833 likely to halt any attempt at a significant recovery.

An interesting day ahead, however I do not see any comments from Fed Chair Powell today which could add volatility as we witnessed yesterday. Keeping this in mind we could be in for continued consolidation ahead of Friday’s NFP jobs report.

Gold (XAU/USD) Daily Chart – March 8, 2023

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.