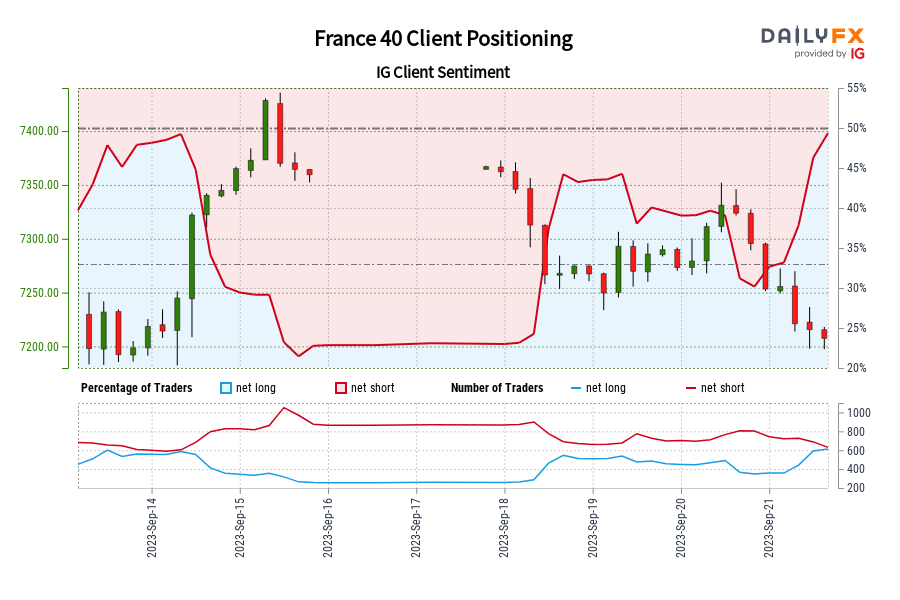

00 GMT when France 40 traded near 7,344.90.

Number of traders net-short has decreased by 25.49% from last week.

| SYMBOL | TRADING BIAS | NET-LONG% | NET-SHORT% | CHANGE IN LONGS | CHANGE IN SHORTS | CHANGE IN OI |

|---|---|---|---|---|---|---|

| France 40 | BEARISH | 50.49% | 49.51% |

72.58% Daily 61.40% Weekly |

-23.62% Daily -25.49% Weekly |

6.29% Daily 2.32% Weekly |

| Change in | Longs | Shorts | OI |

| Daily | 73% | -24% | 6% |

| Weekly | 61% | -25% | 2% |

France 40: Retail trader data shows 50.49% of traders are net-long with the ratio of traders long to short at 1.02 to 1. In fact, traders have remained net-long since Sep 14 when France 40 traded near 7,344.90, price has moved 1.87% lower since then. The number of traders net-long is 72.58% higher than yesterday and 61.40% higher from last week, while the number of traders net-short is 23.62% lower than yesterday and 25.49% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests France 40 prices may continue to fall.

Our data shows traders are now net-long France 40 for the first time since Sep 14, 2023 10:00 GMT when France 40 traded near 7,344.90. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger France 40-bearish contrarian trading bias.

Comments are closed.