Weekly FX Market Recap: Jan. 23 – 27, 2023

It was a relatively quiet week in the financial markets with major financial hubs out for the Lunar New Year holiday, and no major surprises from a much lighter economic calendar this week.

On Monday, ECB President Lagarde said that rates will “have to rise significantly at a steady pace” and “stay at those levels for as long as necessary”

Lunar New Year holidays in closed major financial hubs across Asia, including China, Hong Kong, Singapore through Thursday

Bank of Japan Core CPI in December: 3.1% y/y vs. 2.9% y/y

While Flash PMI survey data released on Tuesday showed likely net sentiment improvement for January, most businesses still see contractionary conditions.

- U.K. Flash manufacturing PMI increased from 45.3 to 46.7 in January

- U.S. Flash Manufacturing PMI for January 2022: improved to 46.8 vs. 46.2 in December; “companies continued to highlight subdued customer demand and the impact of high inflation on client spending.”

- Eurozone’s manufacturing PMI up from 47.8 to 48.8, services PMI higher from 49.3 to 50.2 in January

- Japan’s manufacturing PMI unchanged at 48.9, services PMI higher from 51.1 to 52.3 in January

Argentina and Brazil, South America’s top two major economies, are discussing a common currency to lessen their reliance on the U.S. dollar.

API reports larger than expected private oil inventory build up of 3.4M barrels

Australia’s CPI rose from 1.8% to 1.9% q/q in Q1, higher than the general 1.6% estimate

As expected, the Bank of Canada raised the benchmark overnight interest rate to 4.5% from 4.25%, and signaled that it would likely pause hikes for now

In a significant shift from the previous position, the United States and Germany both announced on Wednesday that they will deliver dozens of tanks to Ukraine.

EU considers capping Russian diesel prices at $100/barrel

U.S. Core PCE (the Fed’s preferred inflation tool) in December: +0.3% m/m as expected; +5% y/y (still above Fed’s 2% y/y target)

Bank of Japan Summary of Opinions: no signs that the BOJ will be making a hawkish shift in its January meeting

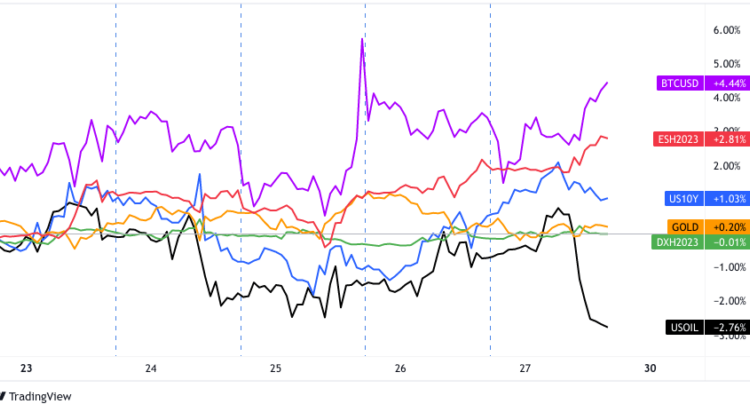

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay 1-Hour by TradingView

As we can see in the chart above, price action across the financial markets was choppy and mixed this week. While the forex calendar did have a few top tier economic/sentiment updates to get traders going, most reports came without any big surprises to spur volatility.

Also, the quiet price action may have be due to holidays in Asia (mainly Lunar New Year) shutting down activity in many of the major financial hubs through Thursday.

The same major themes continue to dominate sentiment, including the current expectation that the Fed will slow the pace of rate hikes (thus lowering the probability for a deep U.S. recession. This idea was supported further this week by a better-than-expected U.S. GDP read on Thursday and an inline (but steadily declining) U.S. Core PCE Price Index read on Friday.

Aside from U.S. economic data, flash PMI’s were released this week to give traders an update on business sentiment from around the globe. On net, it looks like there was an uptick in optimism for January, but overall, businesses see contractionary conditions as high prices remain a burden, leading to lower demand in products and slowing job growth in manufacturing sectors. The services sector was a bit on the opposite end of the spectrum on the job front as many were still looking to expand their workforce.

On the monetary policy front, it was a mixed picture as rhetoric from the European Central Bank officials continued to be hawkish (including calls from ECB governing council member Klaas Knot that the ECB will hike 50 bps in February and March), versus the latest Summary of Opinions from the Bank of Japan, which re-iterated that they will continue to hold their stimulative monetary policies. These stances are already known and unchanged from previous weeks, which is likely why there was no noticeable reaction from traders this week.

Once again, there were no major catalysts this week and in terms of risk sentiment, it looks like there was a positive lean as equities and crypto spent much of the time in the green. It was likely that they benefited from the shifting perception on the Fed’s rate hike outlook, and possibly a continued technical bounce from the beatdown taken in 2022.

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

Sideways price action for the Greenback this week despite top tier economic events like business sentiment updates, GDP and inflation updates in the pipeline. Again, no major surprises this week so it’s likely traders stood pat in anticipation of the FOMC statement coming next week.

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Aussie inflation was one of the more highly anticipated events this week for forex traders as the outcome will likely guide the RBA’s decision at their upcoming meeting. And based on the price action, it looks like traders were expecting a hot CPI read, which they got as it came in higher-than-expected at 1.9% q/q (1.6% q/q forecast).

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

The Loonie spent most of its week in chop mode relative to the majors, but did have that short burst of volatility thanks to the latest monetary policy statement from the Bank of Canada on Wednesday.

The 25 bps rate hike to 4.50% was expected and with the BOC signaling a pause in rate hikes to assess their effects on the economy, it shouldn’t have been much of a surprise that the Loonie fell after the event. That fall was short-lived though as the Loonie likely recovered with the positive global risk-on sentiment this week.

Comments are closed.