The Single Most Overlooked Component Of Trading » Learn To Trade The Market

Time: The single most overlooked component of trading. Yet, it is time that is arguably the most important factor in determining whether a trade ends up a win or a loss. A trade that you close out after two hours for a loss may have ended up a huge winner if you held it for two weeks. As humans, WE are certainly the weakest link when it comes to trading, because most of us have very little patience, self-discipline and self-control, especially when it comes to holding our trades.

Time: The single most overlooked component of trading. Yet, it is time that is arguably the most important factor in determining whether a trade ends up a win or a loss. A trade that you close out after two hours for a loss may have ended up a huge winner if you held it for two weeks. As humans, WE are certainly the weakest link when it comes to trading, because most of us have very little patience, self-discipline and self-control, especially when it comes to holding our trades.

Nearly all of the best trades I’ve personally taken or that I’ve seen our members take, took a lot longer to play out than any of us originally expected or perhaps wanted. However, the fact of the matter is that what we want and expect to happen is typically not what the market has in store.

The bedrock of trading success consists of holding trades for longer than you want in most cases; letting them play out without your interference and just accepting that the market and price take TIME to do their thing. Look at a chart in hindsight and you will see this for yourself. Go ahead and actually look, count the days, weeks or months that some of the most obvious trade signals took to play out.

The entire logic of holding trades longer than you think you should stems from my belief that traders should use the daily chart time frames and wider stop losses to avoid being stopped out prematurely from short-term market noise. Today’s lesson will show you why you need to start holding your trades longer if you want to obtain long-term trading success…

How to Massively Improve Your Trading Results This Year

The New Year is upon us and as one of your New Year’s trading resolutions, I’m sure you want to improve your trading results. While you might be thinking that is easier said than done, here is the single most important thing you can do to improve your trading this year: Hold your trades for longer and meddle / look at them less.

In this lesson, we are going to look at several daily chart trade setups to show how thinking about time and not just price, can vastly improve your trading results. You must start viewing time just as important as you view the price of the trade you are in. For example, just because your trade is currently negative (but hasn’t hit your stop loss) does not mean it will end up as a loss, because of TIME. Time is your friend in the market, yet most traders make it into an enemy.

When trading the daily chart time frame, I would say the average period you should expect to hold a trade is about 1-3 weeks. I am willing to bet most of you reading this rarely hold your trades that long. Now, that is not meant to be offensive, it is meant to be an eye-opener and a helpful piece of wisdom. Let’s take a look at a few examples on the charts…

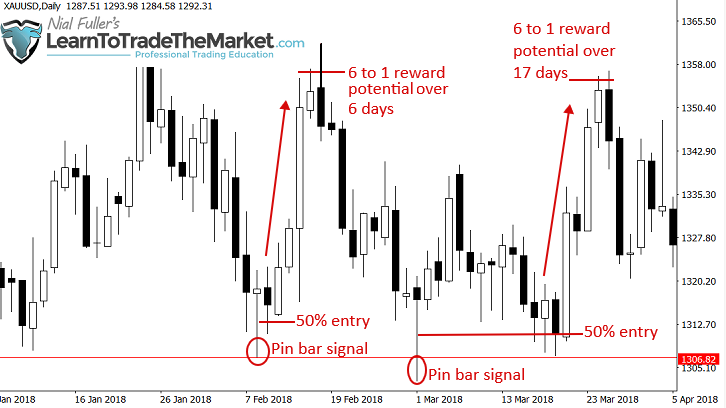

In the daily Gold chart below, we can see a couple of very nice pin bar signals that formed at a key support level. You will notice that the first pin bar saw price move higher fairly fast, but even that one took about 6 full days to play out if you wanted to make a substantial profit. The next pin bar a couple weeks later, took even longer to play out; notice this one took about 17 days to really net you a nice profit. Would you have been able to wait that long for the 50% tweak entry and then for price to move higher? It all boils down to having a plan and sticking to it.

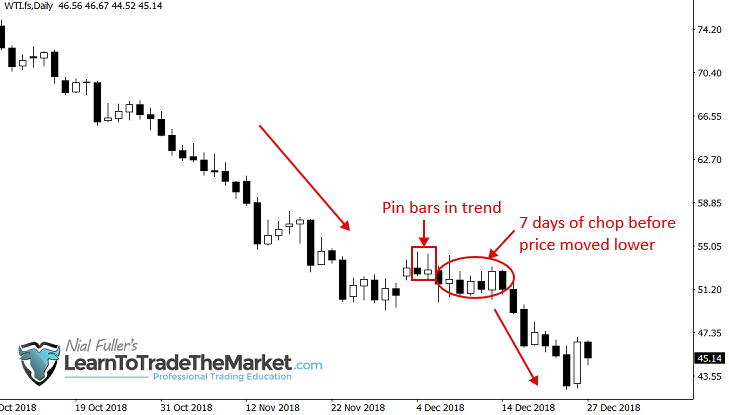

Let us take a look at another chart now. This time it’s WTI – Crude Oil on the daily chart time frame of course. This trade setup formed within a very strong downtrend. We got two bearish pin bars that, whilst small in size, had the weight of a huge trend behind them, so the signals were fine to take. However, you will notice after entering short the market decided to consolidate and move sideways for a full 7 days before finally falling lower again and netting you a profit. It’s sad to say but most traders would have gotten all chopped up and confused in that 7 days, turning would should have been a big winner likely into multiple losing trades.

Use Wider Stop Losses and Stop Meddling with Your Trades

You have a tool on your side to assist you in giving trades the time that they require to turn into big winners. That tool is stop loss placement and more specifically, considering the use of wider stop losses than what you may be used to. Giving a trade even another 50 pips or so can significantly improve the chances of that trade flipping from a loser to a winner. The reason is that many trades are taken (or should be taken) at levels of support or resistance, perhaps after a pullback within the trend, however, we cannot predict exactly how far a market will retrace. So, giving that trade some more “padding” or room near that pullback area can many times avoid a stop out.

When you do increase stop loss distance you naturally increase the time you will need to hold that trade as you are placing the stop outside of the daily and weekly average ranges of price movement (or at least this is the goal). For example, the EURUSD moves, on average, 150 – 200 pips a week so if your target is 400 or 600 pips wide, you have to WAIT and there is no way around this.

However, remember, wider stops will KEEP US IN THE GAME LONGER AND IMPROVE OUR CHANCES OF SUCCESS OVER A SERIES OF TRADES. And that is the goal, is it not?

Here’s an example: The daily Crude Oil chart below shows us two very nice back-to-back daily bullish pin bars that formed. Price then creeped sideways for a few days before just barely violating the low of those pins and then sling-shotting higher. What a cruel fact it is that most traders who entered long off these pins got stopped out for a loss at the low of the bars right before price surged higher. The solution? Increase your stop distance and that loss becomes a win. Don’t be greedy by choosing the tighter stop just so you can increase your position size. Remember, bulls and bears make money but pigs get SLAUGHTERED by the market. Are you a bull, bear or pig?

Here’s another prime example of how wider stops as well as having the patience to give a trade time to play out can yield a monster profit…

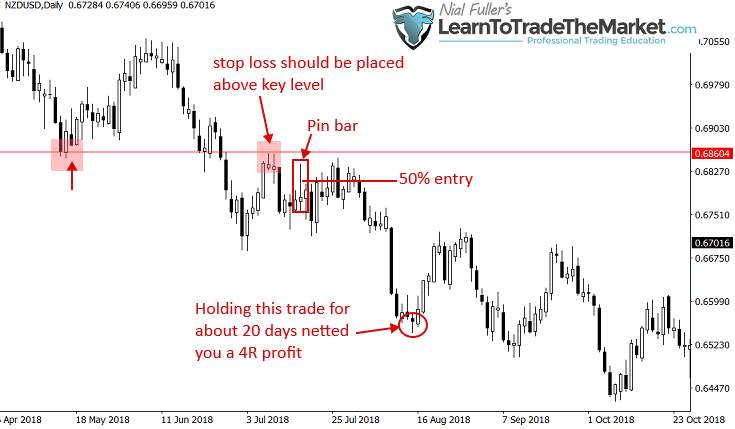

We are looking at the daily NZDUSD chart this time and we can see a very clear and obvious bearish pin bar sell signal formed near a resistance level. Now, what’s most important here is the key resistance level just overhead. You need to place your stop loss just beyond that level, NOT the pin bar high. It literally is the difference between a loss and win. Notice if you entered the trade on a 50% tweak entry price creeped a little higher after that and just violated the pin high (but stayed under the resistance level) before selling off. Notice you had to wait for 20 days to make a nice profit, but if you just set and forget this trade you are literally doing NOTHING while making money! Don’t make it harder than it needs to be!

Patience and Discipline – Do You Have Them?

Of course, the “glue” that makes all of this “waiting” and “doing nothing” possible is patience and discipline, two things that many people struggle with in our age of “I want it now” mentality. It is only when a trader chooses to stick to his plan and stay the course in the face of temptation, that a well-executed trade can yield monster returns.

In my experience, even the best most obvious trades that come off in your direction right away, still take about a week, sometimes more, to really turn into big wins. Case in point, this setup from the AUDUSD daily chart earlier this year. The trend was overall down and price had swung back up to a key resistance area and formed a very obvious bearish pin bar sell signal. Price moved lower the very next day but many traders probably settled for a small profit after just that one day instead of holding it for 6 days and waiting for price to hit that next support area, netting a much larger profit…

Conclusion

What I want you to take away from this lesson is that you need to start thinking about TIME as a critical component to trading success, not just as an afterthought. Every time you enter a trade you need to be prepared to give it the space and time it needs to potentially turn into a winner, or else you will be enduring many unnecessary losses.

Don’t be in a rush to make money because this is simply greed and as you know, greedy people end up losing in the market. You need to not get too attached to your trades and trading, and the main way you do this is by controlling your risk and not over-leveraging your trading account, but also, by not being in a rush and over-trading.

The traders who make money and end up in the infamous “10% of traders who are successful” are the ones who are brave enough to hold trades and who have the patience to not get shaken out by every little fluctuation in the market. You don’t want to be reactionary like an animal in the wild, you want to be skilled and patient, like an intelligent human being who is using their frontal lobe to control their impulses.

If you want to learn more about how I trade with simple price action patterns like the ones in today’s lesson as well as how I manage my emotions and money in the market, check out my freshly updated price action trading course for more in-depth education and training.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.

Comments are closed.