GBP/USD – Technicals fail to provide a directional clue

GBP/USD outlook: Bulls face strong headwinds but remain in play, US inflation data in focus

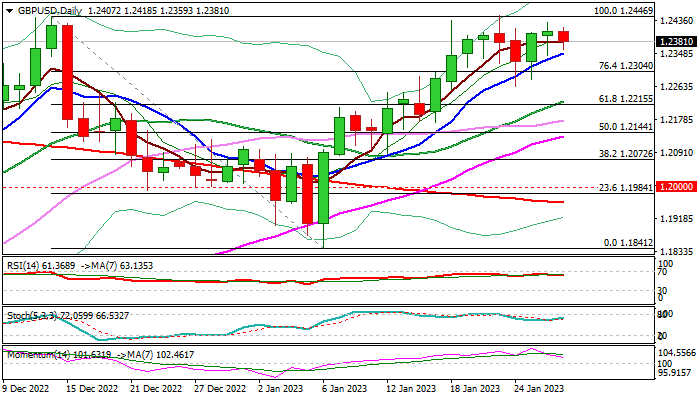

Cable edges lower in early Friday’s trading as bulls continue to face headwinds and repeatedly failing to sustain gains above 1.24 mark, keeping the price action in sideways mode for one week. Strong barrier at 1.2446 (base of falling weekly cloud/Dec 14 top) continues limit recovery leg from 1.1841 (Jan 6 low), though near-term action is expected to keep bullish bias while holding above 1.2263 (Jan 24 higher low).

Daily techs are weakening on fading bullish momentum and south-heading RSI, but MA’s remain in bullish setup, with 10DMA offering initial support at 1.2349 ahead of 1.2263 pivot. Thick daily cloud also underpins (cloud top lays at 1.2166). Read more …

GBP/USD Forecast: Technicals fail to provide a directional clue

GBP/USD has lost its traction and declined below 1.2400 early Friday. As markets await the December Personal Consumption Expenditures (PCE) Price Index data from the US, the pair could stay in a consolidation phase amid mixed technical signals.

The stronger-than-expected fourth-quarter Gross Domestic Product (GDP) data from the US allowed the US Dollar hold its ground against its rivals late Thursday. With Wall Street’s main indexes extending the bullish rally, however, risk flows helped GBP/USD limits its losses. Read more …

GBP/USD hangs near daily low, well offered below 1.2400 ahead of US PCE Price Index

The GBP/USD pair continues with its struggle to find acceptance above the 1.2400 mark and comes under some selling pressure on the last day of the week. The pair remains on the defensive through the first half of the European session and is currently placed around the 1.2380-1.3375 region, just a few pips above the daily low.

A combination of factors lends support to the US Dollar, which, in turn, is seen exerting some downward pressure on the GBP/USD pair. The better-than-expected US growth figures released on Thursday fueled speculations that the Fed will maintain its hawkish stance for longer. This, in turn, leads to a goodish intraday move up in the US Treasury bond yields, which, along with a softer risk tone, benefits the safe-haven Greenback. Read more …

Comments are closed.